Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

UPDATE: Wells Fargo announced in early 2022 that it eliminated NSF fees and created a grace period to avoid overdraft fees. However, many customers will still be subject to $35 overdraft fees, and in December 2022, the bank agreed to pay a record $3.7 billion in fines and restitution for ongoing bad behaviors, including charging surprise overdraft fees even though customers had enough money in their accounts to cover transactions at the time the bank authorized them. Wells Fargo’s overdraft policy is increasingly complex, so make sure you understand how it works.

Wells Fargo’s overdraft limits, fees and overdraft protection services can be confusing. You could be subject to no overdraft fees or $105 in daily overdraft fees for the same transactions, depending upon how your overdraft protection is set up.

Let’s show you how to avoid overdraft fees, the possibility of having fees waived, and information on exactly what you can expect if your account is overdrawn. You will also find useful information on the use of no-fee overdraft apps and cash advance apps.

What we’ll cover:

- Wells Fargo’s Overdraft Policy

- Wells Fargo’s Overdraft Fees

- What is Wells Fargo Overdraft Limit?

- Wells Fargo NSF Fees

- Possibility of Waiving Wells Fargo Overdraft Fees

- How to Avoid Overdraft Fees

- What to do Next

Why have 14 million people ditched their high-fee bank for Chime?

What is Wells Fargo’s Overdraft Policy?

Wells Fargo defines an overdraft as any transaction that is made during a time in which there are not sufficient funds available to cover the transaction. Wells Fargo charges $35 per overdraft transaction up to three overdraft fees per day is you are enrolled in standard overdraft coverage on most consumer checking accounts.

Wells Fargo allows overdrafts on the following transactions, at their discretion:

- Checks and other transactions made using your checking account number

- Automatic bill payments (such as recurring debit card and ACH payments)

- Note that ATM withdrawals and debit card purchases are NOT covered!

Wells Fargo allows some transactions to cause your account to go into overdraft at their discretion. Some factors they may take into account when deciding whether or not to approve an overdraft transaction include account history, the importance of the transaction, whether or not there is a standard scheduled direct deposit to be expected soon, and whether or not you have an overdraft protection plan in place.

You can also opt-in to participate in Wells Fargo overdraft protection, which requires you to link a Wells Fargo savings account and/or credit card to your checking account. With overdraft protection, Wells Fargo will automatically transfer funds from your linked account(s) to your checking you account to cover transactions that will turn your balance negative. ATM withdrawals and debit card purchases are covered with overdraft protection.

How Much are Wells Fargo’s Overdraft Fees?

Wells Fargo charges a $35 overdraft fee per transaction for customers with standard overdraft coverage. You can be charged for up to three overdraft fees per day, for a total of $105. Customers enrolled in overdraft protection are not charged overdraft fees.

Wells Fargo has eliminated NSF fees (non-sufficient funds) as of March 2022.

There is a Wells Fargo grace period to avoid overdraft fees. You have until midnight (Eastern time) of the following business day to bring your account balance back to positive territory.

Wells Fargo does not charge a continuous overdraft fee to consumers whose accounts have remained in a state of negative balance. However, Wells Fargo may decide to freeze your account if its negative balance is not met within a reasonable timeframe.

WAIT! High overdraft fees aren't the only way Wells Fargo is costing you money.

With inflation overheating, you've probably heard that interest rates are climbing sharply. That means that for the first time in years, it's a great time to shop around for a high interest savings account.

Wells Fargo savings accounts currently pay just 0.15% APY1 as of 11/22/2022. That means that if you have $2,500 in a savings account, you'd earn just $3.75 after one year! Move those hard-earned savings to an FDIC-insured bank paying 3.50% APY and you'd earn $87.49 after one year, and some banks now pay even higher rates!

Don't let your hard-earned savings sit there doing next to nothing. Check out the rates that you can earn at other banks:

What is Wells Fargo Overdraft Limit?

Your Wells Fargo overdraft limit is dynamic, and may change as often as daily. Unfortunately, Wells Fargo does not disclose to customer how much they can overdraft, so it can be a guessing game as to whether or not a debit card or ATM overdraft transaction will be approved.

Your Wells Fargo overdraft limit is based on a number of factors, including the age of your account, your average daily balance, the frequency and amount of any recurring deposits, your account history, and other items. The amount and type of transaction also factors into whether or not it will be approved under your overdraft limit. Generally, bill payments and recurring transactions are more likely to be approved than one-time debit card purchases and ATM withdrawals.

Wells Fargo will let you overdraft at an ATM if you are enrolled in overdraft protection (which requires a linked Wells Fargo Account). You will not be able to access cash from an ATM if your account is only subject to standard overdraft coverage (or if you have opted out of standard overdraft coverage).

Even so, the amount of withdrawal and final approval of overdraft cash withdrawal is still at the discretion of Wells Fargo.

How to enroll in Wells Fargo’s Debit Overdraft Service Protection:

- Option one: apply through your Wells Fargo Online Services Account

- Option two: change your overdraft protections in your Wells Fargo App

- Option three: Call Wells Fargo customer service at 1(800) 869-3557.

- Option four: visit your local Wells Fargo branch and ask for assistance. Be sure to bring your ID and account information.

You may also opt-out of your Wells Fargo Debit Overdraft Service Protection Plan by following any of the options above if you want to ensure you do not accidentally overdraw your account at an ATM.

Need a little extra cash next time you withdraw? Try these quick and easy solutions…

- “I want to borrow $50”

- “I need to borrow more, like a hundred bucks”

- “I need a quick $200 and my credit isn’t great”

Does Wells Fargo Charge NSF Fees?

Wells Fargo NSF fees are $0.

Wells Fargo does not charge NSF (non-sufficient funds) fees on returned items that were deemed non-payable at Wells Fargo’s discretion.

For example: if your account balance is $10 and the $105 check you used at the grocery store comes in for processing, Wells Fargo can decide to return the check unpaid to the grocery store. You will now owe the balance to the grocery store plus any returned check fees the grocery store may charge, but your account will not incur any fees.

Can You Get a Wells Fargo Overdraft Fee Waived?

Despite what many people may believe, it is, in fact, possible to get a Wells Fargo overdraft fee waived.

If you are charged for an overdraft transaction or transactions on your account, call customer service or visit your local Wells Fargo branch and ask if these overdraft fees can be waived.

I have personally had several overdraft fees waived throughout the years by simply speaking with customer service on the phone. The conversation went something like this:

- Customer service rep: Hi, thank you for being a loyal customer. How can I help you today?

- Me: Hi, my account has been overdrawn and I’d like to request a refund for my overdraft fees, if possible.

- Customer service rep: Sure, let me see if I can help you with that.

- <<on hold>>

- Customer service rep: It seems as though you’re expecting your paycheck to be deposited in three days. We will freeze your account until your direct deposit comes in and waive these overdraft fees for you since you are such a loyal banker. Is there anything else I can help you with at this time?

Easy-peasy! You can contact Wells Fargo customer service at 1(800) 869-3557.

How To Avoid Overdraft Fees with Wells Fargo

Overdraft fees are frustrating. According to AARP, overdraft fees and NSF fees add up to approximately 75% of annual checking account fees. Aside from utilizing Wells Fargo’s overdraft protection programs, you can avoid overdraft fees in a couple of other ways.

Option #1: Make full use of your Wells Fargo app

You can set low balance alerts on your Wells Fargo app. These alerts will notify you when your bank account balance has reached a specified (upon your preference) low threshold amount.

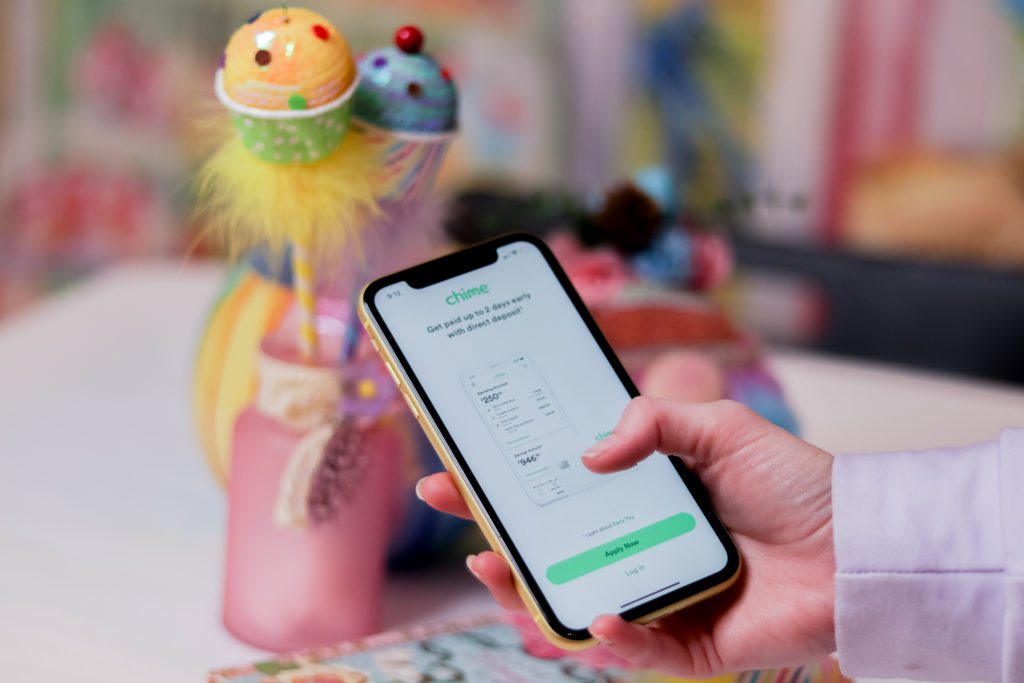

Option #2: Take advantage of no-fee overdraft apps such as Chime’s SpotMe for up to $200 in fee-free overdrafts

When you enroll in Wells Fargo’s overdraft protection services, you are subject to the discretion of Wells Fargo.

No-fee overdraft apps, such as Chime’s SpotMe app, are not affiliated with Wells Fargo and will not use the “power of their discretion” over you.

Enrolling in SpotMe is free, and once your account is set up to receive a $200 direct deposit or more a month, you’re good to go with limits starting at $20 and going up to $200 – all with no overdraft fees. You can access extra cash when you need it instantly, straight through your Chime card.

Here’s an example of how SpotMe can help you avoid sky-high overdraft fees:

Let’s say you’re living paycheck to paycheck (no worries, many of us are), and your best friend’s wedding is coming up suddenly. You need $100 for a wedding gift tomorrow, but your next direct deposit isn’t expected until next week, and you only have $5 in your SpotMe account.

You can simply make your $100 transaction from your SpotMe account. The debit transaction will go through without the $35 fee. Remember! If you were to overdraw your Wells Fargo account, even if you have enrolled in Wells Fargo’s Debit Card Overdraft Service Protection, you would be charged a $35 fee.

SpotMe is an excellent long-term tool. However, it will not provide quick access to cash. Check out option #3.

Option #3: Make use of a cash advance app like PockBox for up to $2,500 even if you have bad credit

Cash advance apps, such as PockBox, which allows users to borrow up to $2,500 or 10 times more than most other cash apps, can help you get cash fast when in need.

While this is simply a short-term solution to your financial needs, it can absolutely help you make necessary payments, such as essential bills that need to be paid.

Need Quick Cash? >>> Click here for up to $2,500!

Final thoughts and what to do next…

- Remember that Wells Fargo will charge you $35 per overdraft fee up to three times per day.

- Don’t forget that Wells Fargo may decline payment at their own discretion when your account is overdrawn or will become overdrawn by a present transaction.

- Wells Fargo does not disclose its overdraft limits to customers, so you won’t know how much you can overdraft at an ATM if your account balance is negative,

- Monitor your accounts closely to avoid unwanted fees.

- Contact Wells Fargo with any questions or concerns regarding overdraft fees.

- Make use of no-fee overdraft apps and cash advance apps if you feel you may need their assistance in the future.

Now that you know exactly what to expect if you run out of money more quickly than you thought you should, you can feel confident as a Wells Fargo account holder.

Watch: Wells Fargo cuts overdraft fees

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- Brigit App Review – Fast $250 Cash Advances with No Interest or Late Fees - April 10, 2024

- Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month and Visa debit card activation. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See terms and conditions.

- Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.