Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

A poor credit score makes life tough in more ways than one. Your credit score often determines whether you can buy a new car, get approved for a loan, secure a mortgage or even land a new job (yep, your credit score is THAT big of a deal). Credit builder loans like Credit Strong may help improve your credit score and sock away some savings. However, Credit Strong’s long loan term means you could be stuck paying off your loan for a full decade! To help you figure out the best option for you, we’ve rounded up the top credit-building apps like Credit Strong.

Credit Strong can help you quickly boost your credit by 25 points and build up $1,000 in savings for just a $15 monthly payment. However, you don’t receive any money upfront. You’ll need to make those $15 monthly payments for ten years to get your $1,000 and pay $815 in interest and fees along the way.

Looking for Credit Strong? Get started here.

So are there loan apps like Credit Strong that suit you better?

If you’re struggling with a subprime credit score, you may already have been stung by high interest rates and fees. While people with strong credit can earn hundreds of dollars a year in cash back or credit card rewards points, a low credit score can keep you from getting approved for any loans or credit cards!

When it comes to strategies that can move the needle on your credit score, forget credit repair companies who claim to have a “quick fix”. Hint: they don’t. Building your credit score takes time. Using a credit builder loan can improve your score and help you enjoy greater access to certain financial products.

Credit Strong is one of the most popular credit builder loans, but does that make them the best option?

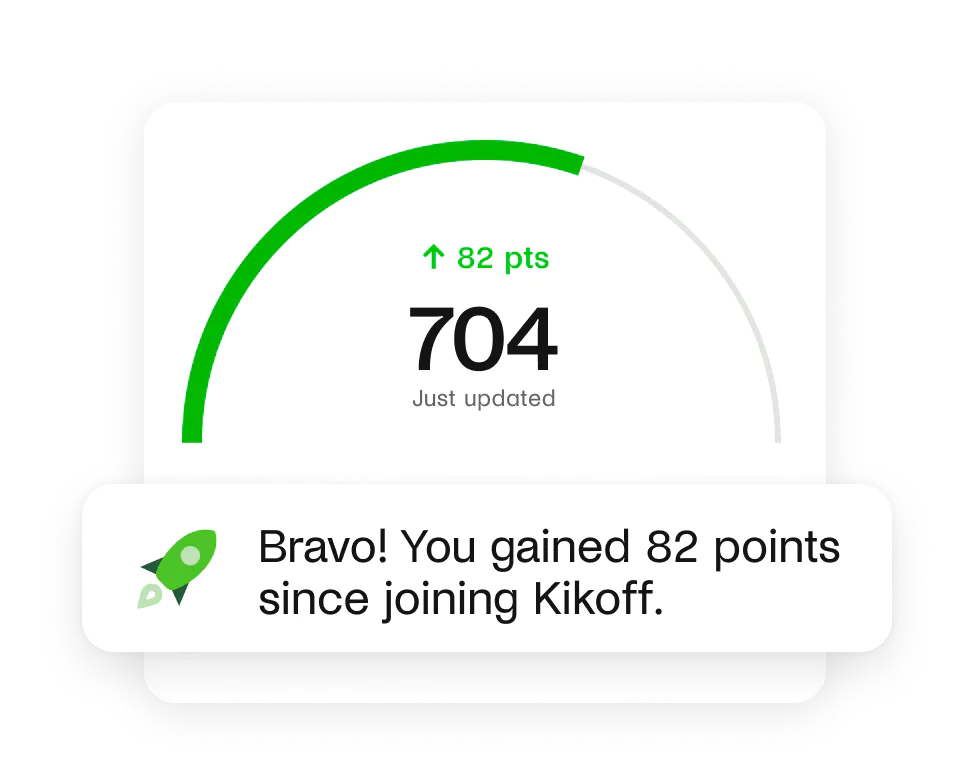

Kikoff Credit can help you build your credit with no credit check and no costly long term commitment.

On average, Kikoff customers with credit scores under 600 increase their credit scores by 58 points, with consistent on-time payments during the account lifetime. Many Kikoff customers have been able to qualify for better car loans, mortgages, credit cards, personal loans, and more.2

Kickoff has helped over 1 million people build credit and costs just $5/month!

How do credit builder loans work?

Unlike a traditional loan, where you’re given your funds upfront and have to pay back the principal plus interest, credit builder loans place your funds in a locked savings account and help you rebuild or establish your credit as you demonstrate a positive payment history.

As you make regular payments, they are reported to the major credit bureaus. Payment history is the largest component of your credit score. Just a few months of on-time payments can contribute to a significant increase. Once your loan is paid off (including any interest and fees), the savings account is unlocked, and you receive the loan proceeds. This is how you build up some savings while building up your credit score.

Since the amount you’re borrowing is held as collateral, there’s less risk involved from lenders. This makes credit builder loans affordable and easy to qualify for. Many have no credit check requirements. This makes them an effective way to work on your credit score no matter what your credit looks like today!

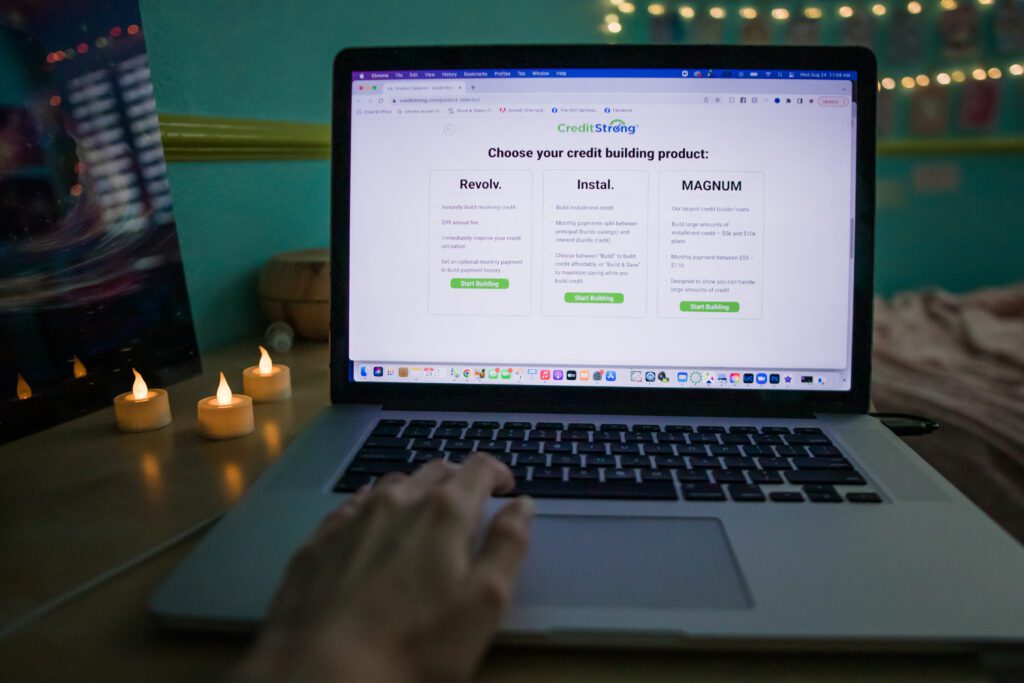

How does a Credit Strong credit builder loan work?

Credit Strong offers small, affordable credit builder loans for $1,000 or $2,500. You can start building your credit for just $15/month.

Each plan helps you build up some savings as you work on your credit. Since there’s no hard credit inquiry, you won’t have to worry about your credit score dropping. Whether you’re borrowing a little or a lot, every plan is risk-free, meaning:

- No credit score required

- No upfront security deposit

- No credit check (easy approval)

- Cancel any time (at no cost)

For example, with the Build 1000 plan, you would make 120 monthly payments of $15 (plus the $15 administrative fee), which totals $1,815. You will receive back $1,000 at the end of the plan, so the total finance charge is $815.

Credit Strong has over 1 million customers with products built for people with bad credit. That means no stressing over whether you’ll be approved, and with free credit score monitoring, you can track your progress.

Is Credit Strong sounding like the right app for you so far?

Before you apply (it only takes a few minutes!), it’s worth comparing credit-building apps like Credit Strong for access to the best credit-building products that suit your needs and lifestyle.

Although credit builders have been shown to boost credit scores (Credit Strong customers see their scores improve by an average of 25 points within three months of opening their account), there are downsides to be aware of. For example, credit builder loans won’t release your cash until your loan is repaid. You may be stuck without the money you desperately need. Credit Strong’s loans have a ten-year term, so you could make payments (including interest) for a full decade before receiving your loan proceeds!

Build your credit score and your savings >>> Get started with Credit Strong

Since knowledge is power, here are some of our favorite alternatives.

Credit builder loan alternatives to Credit Strong

We’ve broken down the full pros and cons in our in-depth Credit Strong review, but if you’re looking for upfront cash or different financial features, it helps to know what’s out there. To help you avoid unnecessary fees and headaches, here are the best credit-building apps like Credit Strong.

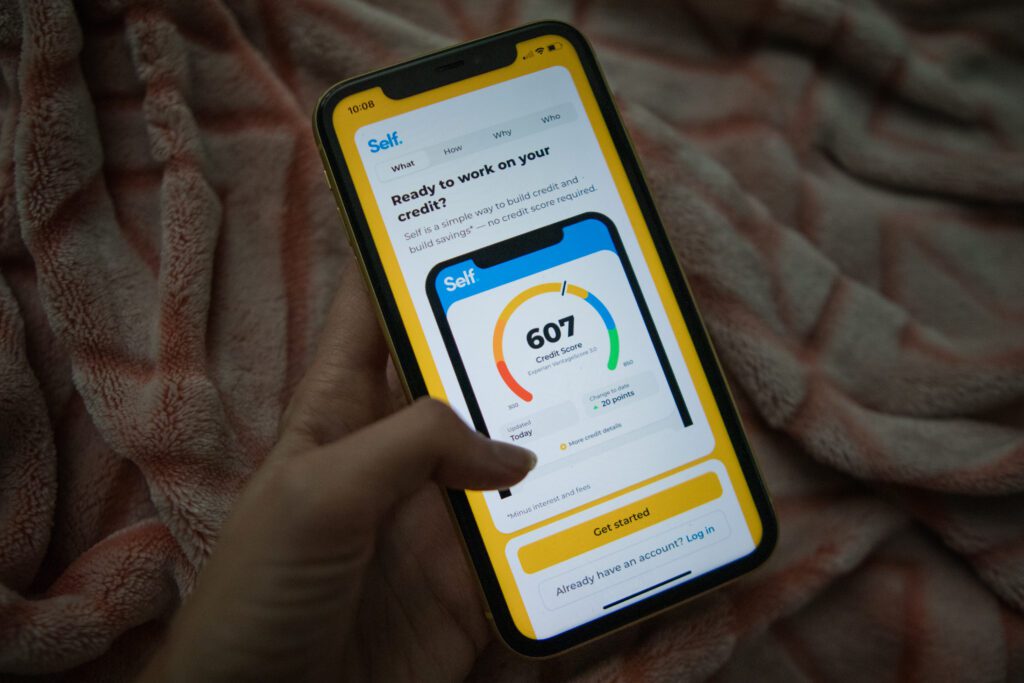

Self – Helping over 1 million people build their credit

Self partners with banks to offer credit builder loans – loans with fixed monthly payments that are specifically designed to help bump up your credit score by reporting your on-time payments to major credit bureaus. You can apply for a loan online or via the Self Financial app in just a few minutes, and a low credit score or no credit file are no problem.

When you open a Credit Builder Loan3 with Self, you commit to making a regular monthly payment for 12 or 24 months.4 At the end of your plan,these funds are yours (less fees and interest) so you’re building up some savings alongside improving your payment history.5

Unlike a traditional personal loan, which will provide you with your loan proceeds before you start making payments, with a credit builder loan through Self your payments are locked in a savings account and are returned to you upon completion of your plan, minus interest and fees.

Along the way, Self reports your monthly payments to the three major credit bureaus (Equifax, Experian and Transunion) each month. Your credit score is based on several factors and the largest component is your payment history. So, making on-time payments on your Self Credit Builder Loan could help bump up your score, sometimes. Self makes it easy to set up automated monthly payments, so you never need to worry about missing a due date.

Adding a Self Financial Credit Builder Loan to your credit profile may also bump your score by adding an installment loan to the types of credit products that you have. Credit bureaus view having multiple types of credit and loans favorably, though this is a smaller factor in your credit score than payment history.

Apps like Self make it easy to track your credit score, so you can see your progress. Plus, there’s no ‘hard pull’ when you apply, so you can see if you are approved without your score receiving a ding. You can also qualify for a Self Visa® credit card in as little as three months6, with a credit line that could be secured to up to $3,000!

Build your credit and your savings >>> Check out Self

MoneyLion Credit Builder Plus – Access some money upfront while you save & build your credit

Most credit builder loans lock your funds and hand you the keys when you’ve met all your repayment obligations. This is great for building credit – not so great when you need a little extra cash.

MoneyLion’s Credit Builder Plus solves this problem by giving you a portion of your funds right away. The remainder is locked in a savings account. This is alongside access to 0% APR cash advances for up to $300 when you need some extra cash along the way!

Applying for Credit Builder Plus provides loans up to $1,000 (5.99% to 29.99% APRs). A portion of the funds available upfront and the rest when you complete your repayments.

DID YOU KNOW: Over half of Credit Builder Plus customers see their credit score increase by more than 42 points within 60 days of opening an account?

Get funds while you save and build credit >>> Check out MoneyLion Credit Builder Plus

Chime Credit Builder Secured Credit Card – No-interest and no-fee credit card to boost your credit score

Chime Credit Builder is a no-interest and no-annual-fee credit card that can also help boost your credit score by 30 points. If you’re one of the millions of people with credit card debt (14% of Americans have over $10,000 in credit card debt), adding *another* credit card can seem daunting.

Chime removes this fear with a card that’s practically debt-proof. Although the Credit Builder card shares the same purpose as traditional secured credit cards, the similarities end there. Chime’s credit building card requires no credit check, no minimum deposit and $0 in annual fees.

Instead of borrowing against a maximum limit, you set aside money in advance to pay your credit card bill. This amount becomes your new limit, so there’s no way to spend more than your means. Each on-time payment can help you build credit.

You will need to open a Chime account and receive a qualifying direct deposit to your checking account. There are also no rewards or upgrade paths attached to your card. But if you’re just looking to buff out a few scratches and dents in your credit score, the Chime Credit Builder Visa® Credit Card can help.

Get a 0% APR credit card with no credit check >>> Build credit with Chime

Kikoff Credit – Build your credit for just $5/month

Kikoff costs just $60, payable over 12 months – so you can build your credit for only five bucks a month!

Customers with a credit score below 600 see their credit scores increase by 27 points after just one month! Over time, customers who started with a score below 600 see that increase more than double to 58 points7.

Apply online – there’s no credit check – and Kikoff Credit will create a $750 revolving line of credit in your name. You can only use the line of credit to purchase at Kikoff’s online store. This store contains a variety of eBooks on personal finance, wellness and other topics, starting at $10 each. You’re not obligated to purchase anything, and the monthly Kikoff membership payments are reported to Equifax and Experian, which can positively impact your credit score.

Kikoff does not charge interest (0% APR), late fees, administrative fees, or other fees (just the $5 monthly payment for your membership). With just a $60 price tag, apps like Kikoff can greatly impact your credit score. All without taking a big bite out of your wallet.

Build your credit for just $5/month >>> Check out Kikoff Credit

Grow Credit – Build your credit for free!

With Grow Credit, you can easily build your credit score by using a no-interest Mastercard to pay for your monthly subscriptions to popular streaming video, music, and food delivery services. Your on-time payments will be reported to credit bureaus, helping you boost your credit score.

Applying for Grow Credit is quick and easy online or through the app, and bad or no credit won’t prevent you from being approved, as long as you have a valid bank account. Once approved, you’ll receive a $17 monthly spending limit Grow Credit Mastercard to use as the payment method for one or two monthly subscription services. With over 100 services supported, including Hulu, Netflix, Door Dash, and Uber Eats, you’ll have plenty of options to choose from. Plus, Grow Credit provides discounts and free trials to dozens of products like Peacock, Showtime, Bark Box, and Hello Fresh. And you can even qualify for a free Grow Credit account!

Unlike a credit builder loan, you’re paying for services you already use, making it easier to stay within your budget. Note that you cannot use the Grow Credit Mastercard in stores, for online purchases, or to withdraw cash from an ATM.

So does Grow Credit work?

According to a platform study conducted in March 2021, the average user experiences a FICO score increase of 51 points after 12 months of using Grow Credit (though other factors may have impacted scores as well.8

Start building credit for free >>> Check out Grow Credit

SeedFi Borrow & Grow – Access up to $4,000 right NOW while building your credit

SeedFi’s Borrow & Grow plan9 is a personal loan and credit builder in one.

First-time borrowers are eligible for loans from $1,500 to $8,000 with $300 to $4,000 upfront (repayment periods range from 10 to 48 months, and APRs range from 11.59% to 29.99%)10 so you can deal with any urgent expenses. The rest of your SeedFi loan is locked in a savings account until you repay in full with payments reported to the three main credit bureaus which may increase your credit score11. Then, the funds are yours to use in any way you like. Spend them, save them, invest them, it’s up to you!

Here’s an example of how you might use SeedFi’s Borrow & Grow Plan.

Let’s say you need to borrow $500 for car repairs.

You can quickly and easily apply online for a loan like SeedFi. You can see what you qualify for without impacting your credit score.

Once you choose the offer that meets your needs, you can choose how much of your loan you want upfront and how much to deposit in your locked savings account. Let’s say you want to borrow $500 for car repairs and $500 for savings later.

Your upfront amount is typically available within a few days. The remaining amount is yours once you repay the full $1,000 you’ve borrowed (plus interest) over your repayment period. Now you don’t need to stress about your car repairs AND have funds left over for a rainy day!

You can see how much you’ll qualify for on the SeedFi website in a few minutes without impacting your credit score.12

How we picked these apps

To come up with this list of credit builder apps, we picked the top loan apps like Credit Strong, hit the ‘downloaded’ button, and spent time comparing features and reading T’s & C’s. We considered loan features, including total funds, availability of funds, APRs and loan repayment schedules. We also looked for additional features that might help people looking to rebuild or establish their credit. These include soft or hard credit checks, borrowing limits and additional financial features. We may receive a referral fee if you purchase or use some of the products described in this article.

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- Credit Score Increase: Based on Kikoff customers that used the Credit Account product and made consistent on-time payments during account lifetime. This data is based on observed VantageScore 3.0 credit score changes. Payment behavior can have an impact on your credit score, and individual results may vary. Data current as of March 2022.

- All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or SouthState Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A. Member FDIC

-

Sample products: A loan with a $25 month payment, 24 month term with a $9 admin fee at a 15.92% Annual Percentage Rate with a cost to build of $89; A loan with a $35 month payment, 24 month term with a $9 admin fee at a 15.97% Annual Percentage Rate with a cost to build of $125; A loan with a $48 month payment, 12 month term with a $9 admin fee at a 15.65% Annual Percentage Rate with a cost to builde of $46; A loan with a $150 month payment, 12 month term with a $9 admin fee at a 15.91% Annual Percentage Rate with a cost to build of $146. Please refer to www.self.inc/pricing for the most recent pricing options.

- Results are not guaranteed. Other factors, including activity with your other creditors, may impact results. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

- The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender. Card eligibility requirements include having an active Credit Builder Account in good standing, making 3 on time payments and having $100 or more in savings progress. All requirements are subject to change.

- Based on Kikoff customers that used the Credit Account product and made consistent on-time payments during account lifetime. This data is based on observed VantageScore 3.0 credit score changes. Payment behavior can impact your credit score, and individual results may vary. Data current as of March 2022.

- Data is based on an analysis of 13,125 users’ monthly FICO pulls, cohorted and anonymized through March 2021. Individual results will vary.

- Sample Borrow & Grow Plan: Amount Financed: $7,000 ($3,500 accessed up front and $3,500 locked in savings), APR: 24.99%, Finance Charge: $3,318, Total of Payments: $10,318, Payment Schedule: 85 biweekly payments of $120 and one final payment of $118. The payment schedule spans 40 months.

- Advertised rates and terms will be subject to change without notice. Your actual APR and other loan terms will be shown to you as part of the online application process.)

- Based on a simulation conducted with TransUnion® data, customers who opened a SeedFi Credit Builder Plan from March 2021 through August 2021 would have shown an average increase of 41 points on their VantageScore 3.0 credit score if they had added a Credit Builder Prime to their credit profile and made on-time payments on all of their credit accounts for 6 months. Individual results may vary, and late payments can have a negative effect on your credit score.

- If you check your offers, SeedFi issues a soft credit inquiry, which does not impact your credit score and is not visible to creditors. If you select a SeedFi loan offer and continue with your application, SeedFi will issue a hard credit inquiry, which may affect your credit score. Personal loans and banking services provided by SeedFi’s bank partner, Cross River Bank, Member FDIC.