Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

SeedFi, the online platform known for assisting users in building their credit, has announced the discontinuation of its innovative “Borrow & Grow” personal loans. This special program enabled borrowers to access a part of their loan right away, with the remainder being saved in an account for them, available upon completion of loan repayment—primarily catering to those with fair to subpar credit ratings. After being acquired by the tech-based financial powerhouse Intuit in December 2022, SeedFi’s CEO, Jim McGinley, revealed in January 2023 that the company would no longer be offering personal loan services.

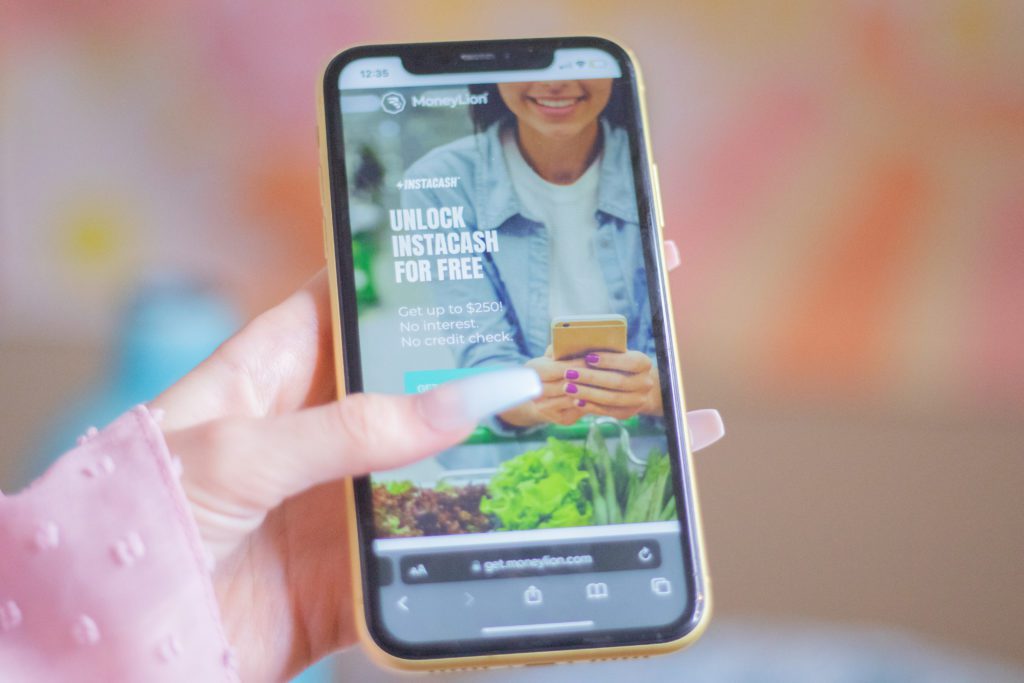

In the search for a SeedFi substitute? MoneyLion’s Credit Builder Plus deserves your attention. While most credit builder loans don’t provide you with any cash until after you’ve made all of your payments (which can sometimes take years!), MoneyLion stands out by letting you access a chunk of your funds right off the bat. This setup provides the dual advantage of immediate cash access while simultaneously working to enhance your credit score.

Plus, if you find yourself a bit short you can also access extra cash when you need it. As a Credit Builder Plus member, you can request a $300 instant cash advance with no credit check, and there’s no interest or late fees. Using Instacash advances won’t impact your credit score, either.

The perks of Credit Builder Plus extend even further. A significant number of its users have reported an impressive rise in their credit scores, with an average surge of over 42 points in a mere two months! For those eager to uplift their credit status while also enjoying some financial flexibility, MoneyLion offers the only major credit builder that gives you access to cash now, later and along the way as well.

Why is MoneyLion one of our favorite cash advance apps?

- Super speed - You could have up to $500 in your bank account in under 10 minutes!

- No, No, No! - No credit check, no interest, no tips, no late fees

- 🏗️ 💳 💵 - Get the only credit builder loan that gives you up to $1,000 right away, with no hard credit check2

SeedFi Credit Builder Loans

SeedFi’s Borrow & Grow plan combined a credit builder and a personal loan. This means you get cash upfront plus extra savings deposited in a locked savings account. The advantage of this type of loan is that your credit score may improve with bi-weekly payments reported to the three major credit bureaus. Plus, your savings are released when you’ve paid off the total, so you have an emergency fund.

Since launching in 2019, SeedFi helped thousands of customers build millions of dollars in savings. As a payday loan alternative, SeedFi can help you out of a tight spot, potentially build your credit and leave you with savings for a rainy day.

But since many credit unions, banks and apps offer credit builder loans and products, it’s natural to ask, “are there loan apps like SeedFi that offer me a better fit?”

We answer that question by rounding up the best plans and products for you.

So read on to compare your options to start working on your credit score.

Kikoff Credit can help you build your credit with no credit check and no costly long term commitment.

On average, Kikoff customers with credit scores under 600 increase their credit scores by 58 points, with consistent on-time payments during the account lifetime. Many Kikoff customers have been able to qualify for better car loans, mortgages, credit cards, personal loans, and more.3

Kickoff has helped over 1 million people build credit and costs just $5/month!

How do credit builder loans work?

Credit builder loans place your funds in a locked savings account to help you build up savings and positive credit history. Some credit builders (like SeedFi’s Borrow & Grow) provide quick access to funding upfront though this isn’t a feature of all credit builder loans (e.g. Credit Strong and Self do not).

Regular payments towards your credit builder loan are reported to the major credit bureaus. This is important because payment history is your credit score’s largest component (up to 35%). Since your track record of paying is typically the strongest indicator of making future payments, just a few months of on-time payments can help boost a flagging credit score.

After your loan is fully paid off – this includes any fees or interest – your savings portion is unlocked. The full amount is yours to invest, save or spend however you like, which makes credit builders so appealing – you build a positive credit history AND walk away with some savings for a rainy day.

SeedFi’s Borrow & Grow plan explained

With the Borrow & Grow plan, you get a small amount of cash upfront while building up savings for later. First-time borrowers can request $300 to $4,000 in immediate cash and $1,250 to $4,500 in savings. This amount is locked in a savings account until you’ve repaid the amount in full.

As a Borrow & Grow customer, you decide how much of your funds are available immediately and how much SeedFi will deposit in a locked account. Not all credit builders offer this flexibility – many give you zero cash upfront! Repayment periods range from 10 to 48 months, and APRs range from 11.59% to 29.99%4

Borrow & Grow advantages:

- Soft credit check to pre-qualify – won’t impact your credit score

- It gives you an emergency fund

- On-time payments may boost your credit score

- Fund a loan within 1 – 2 business days

Let’s say you need a few thousand dollars to cover urgent car repairs, but you’d like to work on your credit simultaneously. Here’s an example of how a Borrow & Grow Plan might look:

Amount Financed: $7,000 ($3,500 upfront and $3,500 locked in savings)

APR: 24.99%

Finance Charge: $3,318

Total of Payments: $10,318

Payment Schedule: 85 bi-weekly payments of $120 and one final payment of $118 (spanning 40 months).

SeedFi will schedule automated payments every two weeks synchronized with your paycheck to help you avoid a late fee of $15 – otherwise, there are no extra fees to worry about.

SeedFi’s Borrow and Grow can be a great tool for certain situations, but it is only available to borrowers in 36 states plus Washington DC. And with interest rates up to 26.99% APR, you might want to compare your options and find a plan or product that won’t require you to pay as much interest and fees along the way.

Before you commit, it’s worth comparing credit-building apps like SeedFi to ensure you’re not paying a higher interest rate than you need to or missing out on extra funds.

Loans like SeedFi Borrow and Grow

We dive deep into the credit building plans in our full SeedFi review, but it pays to have the full picture when working on your credit score. To find the products that meet your needs (and don’t sting you with unnecessary fees and sky-high interest), read on for the best credit-building apps like SeedFi.

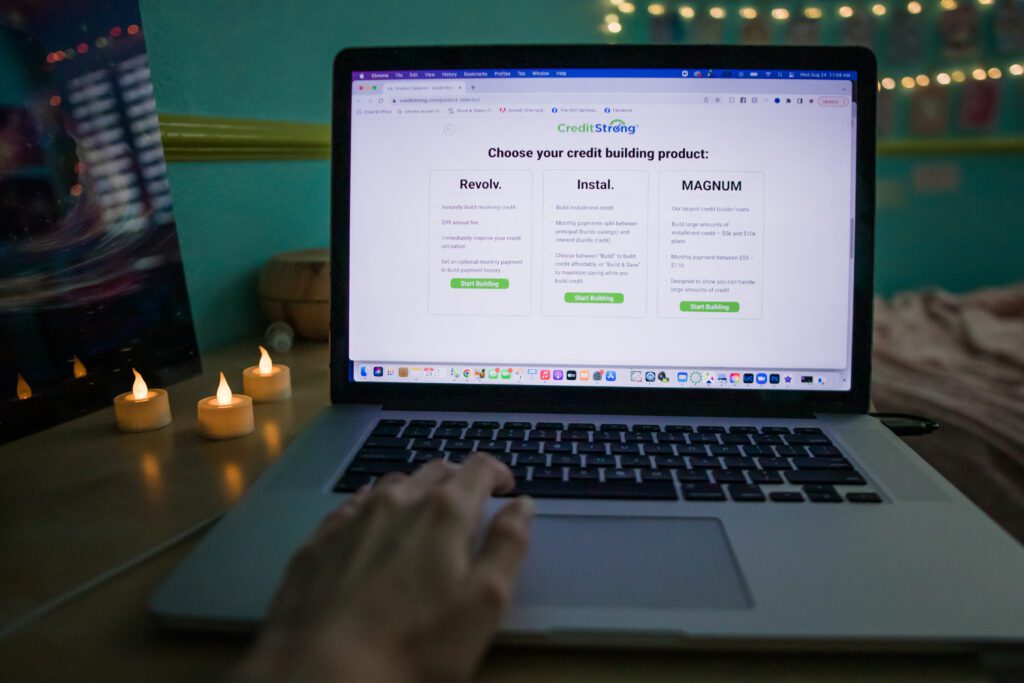

Credit Strong – Diversify your credit mix starting at just $15/month

Credit Strong offers credit builder loans designed to help lift a flagging score. With over 1 million customers, Credit Strong is a popular and legit credit builder product, but you won’t get any cash upfront. Your full loan is deposited in a locked savings account. Your monthly payments cover any interest plus your loan balance. You get the accumulated savings when your loan is repaid.

You won’t get any cash upfront. However, Credit Strong features one of the lowest monthly payments of ANY credit builder plan. Starting at just $15 a month, it’s a way to build credit and savings that should fit nearly any budget. Rates on Credit Strong’s Build 1000 plan are an attractive 13.5% APR, which is less than half of the maximum rates that SeedFi charges.

With the Build 1000 plan, you would make 120 monthly payments of $15 (plus a one-time $15 administrative fee), which totals $1,815. You will receive back $1,000 at the end of the plan, so the total finance charge is $815.

Loans like Credit Strong can be a great option if you are committed to building your credit score but don’t have much wiggle room in your monthly budget.

On average, Credit Strong customers see their credit scores increase by more than 25 points within 3 months of opening their account. Plus, Credit Strong customers who make 12 on-time monthly payments often see their increase by nearly 70 points!

Build your credit score and your savings >>> Get started with Credit Strong

Grow Credit – Build credit for free

Are you looking for a hassle-free way to build your credit score? Then Grow Credit is perfect for you! By using their no-interest Mastercard to pay for your monthly subscriptions to streaming video, music, and food delivery services, you can easily boost your credit score. The best part? Your on-time payments will be reported to credit bureaus, helping you get the credit score you deserve.

And the process is quick and easy! You can apply online or through their app in just a few minutes, and bad or no credit won’t hold you back, as long as you have a valid bank account. Once approved, you’ll get a $17 monthly spending limit Grow Credit Mastercard to use for one or two monthly subscription services. With over 100 supported services, including popular options like Hulu, Netflix, Door Dash, and Uber Eats, you’ll have plenty of options to choose from. Plus, Grow Credit provides discounts and free trials to dozens of products like Peacock, Showtime, Bark Box, and Hello Fresh. You can even qualify for a free Grow Credit account!

The best part is that unlike a credit builder loan, you’re paying for services you already use, so you can easily stay within your budget. Keep in mind that you can’t use the Grow Credit Mastercard in stores, for online purchases, or to withdraw cash from an ATM.

So, ready to take control of your credit score? According to a platform study conducted in March 2021, the average user experiences a FICO score increase of 51 points after 12 months of using Grow Credit.5

Start building credit for free >>> Check out Grow Credit

MoneyLion Credit Builder Plus – Access emergency cash upfront while saving & building your credit

Like SeedFi, MoneyLion’s Credit Builder Plus gives you a portion of your loan upfront. The rest is yours after twelve monthly payments. Plus, you can access MoneyLion’s no-interest cash advances for up to $300 whenever you need some extra dollars along the way.

MoneyLion Credit Builder Plus loans are available for up to $1,000 (5.99% – 29.99% APRs). More than half of MoneyLion members raise their score by 42 points within 60 days.6 Unlike SeedFi’s Borrow & Grow, which is a standalone product, MoneyLion’s Credit Builder Plus provides added benefits.

Credit Builder Plus advantages:

- Cash advances up to $300 at 0% APR

- Personalized credit-building insights and tips

- View your credit score any time

Credit Builder Plus offers a way to get fast cash and avoid debt if you encounter an emergency expense.

Get funds while you save and build credit >>> Check out MoneyLion Credit Builder Plus

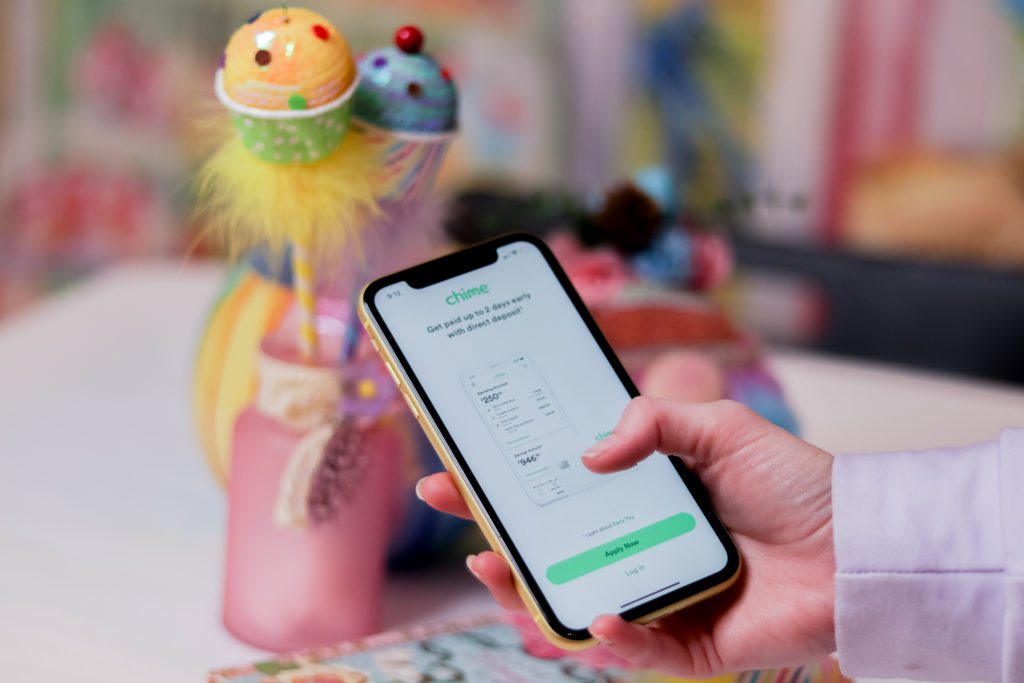

Chime Credit Builder Secured Credit Card – Boost your credit score with 0% interest

Chime’s Credit Builder card is a secured credit card with no interest and no annual fees. If spending more money than you have on credit makes you nervous, you can rest easy. To use your card, you’ll need to transfer funds from your Chime checking account to your Credit Builder account. You’re only spending money you’ve transferred. So there’s zero risk of overspending or splurging on a purchase that you later regret.

Chime reports payments to the three major credit bureaus – Equifax, Experian and Transunion, and Chime Credit Builder Card customers see an average credit score increase of 30 points!7

Chime Credit Builder Card advantages:

- No credit check to apply

- No minimum security deposit required

- You can use your card everywhere Visa is accepted

Since you need a Chime checking account to be eligible, you can also take advantage of your Chime Visa® Debit Card, which comes with Chime SpotMe overdrafts. This feature lets you access up to $200 in fee-free overdrafts when swiping your debit card or withdrawing cash at the ATM.

No interest credit card and up to $200 with no overdraft fees >>> Check out Chime

Kikoff Credit Account – Build your credit for just $5/month

The credit builder loans on this list require on-time payments to improve your credit score. This means late or missed payments can make your score WORSE. Many also include account fees or interest that can add more stress to your finances.

That’s why Kikoff is a popular alternative to help boost your credit without risk or budget blowouts. Kikoff’s Credit Account is a one-year credit-building plan that will cost you $60. This is payable monthly, so you’re building credit safely for just 5 bucks a month!

Unlike the other credit building options on this list, you won’t receive any funds now or later. Instead, the Kikoff app creates a $750 revolving line of credit in your name. You can use this credit to make purchases in Kikoff’s online store, which includes eBooks for $10 – $20 on topics like wellness and finance, though you’re not required to purchase anything.

Kikoff Credit Account advantages:

- 0% APR

- No late or administrative fees

- You decide how much to spend

Kikoff customers with a credit score below 600 see their credit scores increase by 27 points after just one month! And over time, that increased more than double to 58 points for customers who continue to make on-time payments to Kikoff and other lenders.8

Build your credit for just $5/month >>> Check out Kikoff Credit

Self – Helping over 1 million people build credit and savings

When you open a Credit Builder Loan9 with Self, you commit to making a regular monthly payment for 12 or 24 months.10 At the end of your plan,these funds are yours (less fees and interest) so you’re building up some savings alongside improving your payment history.11

Unlike a traditional personal loan, which will provide you with your loan proceeds before you start making payments, with a credit builder loan through Self your payments are locked in a savings account and are returned to you upon completion of your plan, minus interest and fees.

Along the way, Self reports your monthly payments to the three major credit bureaus (Equifax, Experian and Transunion) each month. Your credit score is based on several factors and the largest component is your payment history. So, making on-time payments on your Self Credit Builder Loan could help bump up your score, sometimes. Self makes it easy to set up automated monthly payments, so you never need to worry about missing a due date.

Adding a Self Financial Credit Builder Loan to your credit profile may also bump your score by adding an installment loan to the types of credit products that you have. Credit bureaus view having multiple types of credit and loans favorably, though this is a smaller factor in your credit score than payment history.

The Self app makes it easy to track your credit score, so you can see your progress. Plus, there’s no ‘hard pull’ when you apply, so you can see if you are approved without your score receiving a ding. You can also qualify for a Self Visa® credit card in as little as three months12, with a credit line that could be secured to up to $3,000!

Build your credit and your savings >>> Check out Self

How we picked these apps

To come up with this list of credit builder apps, we picked the top loan apps like SeedFi, hit the ‘downloaded’ button, and got busy comparing features and reading T’s & C’s. We considered loan features, including total funds, availability of funds, APRs and loan repayment schedules. We also looked for additional features that might help people looking to rebuild or establish their credit. These include soft or hard credit checks, borrowing limits and additional financial features. We may receive a referral fee if you purchase or use some of the products described in this article.

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- When you apply for CreditBuilder Plus, MoneyLion will perform a soft credit pull to review certain financial information. This soft inquiry has no impact to your credit score and may or may not be recorded in your credit reports depending on the bureau. This is unlike a hard credit pull which affects your credit score and can appear on your credit report for two (2) years. Credit score improvement is not guaranteed. A soft credit pull will be conducted that has no impact to your credit score.

- Credit Score Increase: Based on Kikoff customers that used the Credit Account product and made consistent on-time payments during account lifetime. This data is based on observed VantageScore 3.0 credit score changes. Payment behavior can have an impact on your credit score, and individual results may vary. Data current as of March 2022.

- Advertised rates and terms will be subject to change without notice. Your actual APR and other loan terms will be shown to you as part of the online application process.)

- Data is based on an analysis of 13,125 users’ monthly FICO pulls, cohorted and anonymized through March 2021. Individual results will vary.

- Credit score improvement is not guaranteed. A soft credit pull will be conducted that has no impact to your credit score. Credit scores are independently determined by credit bureaus. Data was sourced from credit score data from over 74,000 Credit Builder Plus members with an active loan between August 7, 2019, and February 18, 2021. Credit score improvement is not guaranteed. Credit scores are independently determined by credit bureaus. MoneyLion is not a Credit Services Organization. Credit Builder Plus is an optional service offered by MoneyLion.

- Based on a representative study conducted by Experian®, members who made their first purchase with Credit Builder between June 2020 and October 2020 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

- Based on Kikoff customers that used the Credit Account product and made consistent on-time payments during account lifetime. This data is based on observed VantageScore 3.0 credit score changes. Payment behavior can have an impact on your credit score, and individual results may vary. Data current as of March 2022.

- All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or SouthState Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A. Member FDIC

-

Sample products: A loan with a $25 month payment, 24 month term with a $9 admin fee at a 15.92% Annual Percentage Rate with a cost to build of $89; A loan with a $35 month payment, 24 month term with a $9 admin fee at a 15.97% Annual Percentage Rate with a cost to build of $125; A loan with a $48 month payment, 12 month term with a $9 admin fee at a 15.65% Annual Percentage Rate with a cost to builde of $46; A loan with a $150 month payment, 12 month term with a $9 admin fee at a 15.91% Annual Percentage Rate with a cost to build of $146. Please refer to www.self.inc/pricing for the most recent pricing options.

- Results are not guaranteed. Other factors, including activity with your other creditors, may impact results. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

- The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender. Card eligibility requirements include having an active Credit Builder Account in good standing, making 3 on time payments and having $100 or more in savings progress. All requirements are subject to change.