Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

UPDATE: Truist has debuted two new checking accounts in July 2022 with no overdraft fees. However, these accounts have low or no overdraft limits and other restrictions. Read on for details!

| Fee | Cost | Maximum Overdrafts Fees Per Day | Maximum Daily Cost |

| Truist Overdraft Fee | $0 | 0 | $0 |

| Truist Insufficient Funds Fee | $0 | 0 | $0 |

| Truist Linked Account Transfer Fee | $0 | N/A | $0 |

Preparing for unexpected expenses can be difficult. You never know when a medical emergency or repair bill will come up, or when you’ll find yourself stranded and in need of cash.

These situations can cause you to overdraw your bank account and incur an overdraft fee. If you’re a Truist customer or former BB&T account holder, read on to learn more about how much you can expect to spend on overdraft fees, how you can avoid these fees, and what alternatives are available.

Why have 14 million people ditched their high-fee bank for Chime?

What we’ll cover:

- How much does Truist charge when you overdraw your account?

- Does Truist provide overdraft protection by default?

- Is there an overdraft limit to how much you can withdraw once your account balance falls below zero?

- What are the best alternatives to over-drafting your bank account?

What Is Truist’s Overdraft Policy?

BB&T and SunTrust Banks merged to form Truist in 2019. In July 2022, Truist announced substantial changes to its overdraft policies resulting in the elimination of overdraft fees for many account holders!

Truist’s most popular checking account offering, Truist One Checking, charges no overdraft fees. The account does carry a $12 monthly fee, which is waived if you meet the average balance or direct deposit criteria.

You can qualify for a negative balance buffer of up to $100 by having an account that is at least 35 days old, has a positive balance, and has received a monthly direct deposit of $100 or more for each of the past two months. (If you don’t meet this criteria, check out these banks that let you overdraft right away.)

If you want the ability to overdraft your account by more than $100 or don’t qualify for the buffer, Truist checking customers can also opt-in for overdraft protection and coverage. However, the default is to have your account opted out, which means Truist will decline ATM and debit card transactions if your balance is too low. If you don’t participate in the buffer or overdraft protection, your transactions will be declined if they will push your balance negative.

Truist allows overdrafts for these transactions by default:

- Checks

- ACH

- Recurring payments

You can get overdraft protection for more transaction types if you decide to opt-in, including:

- ATM withdrawals

- Debit card transactions

How Much Are Truist Overdraft Fees?

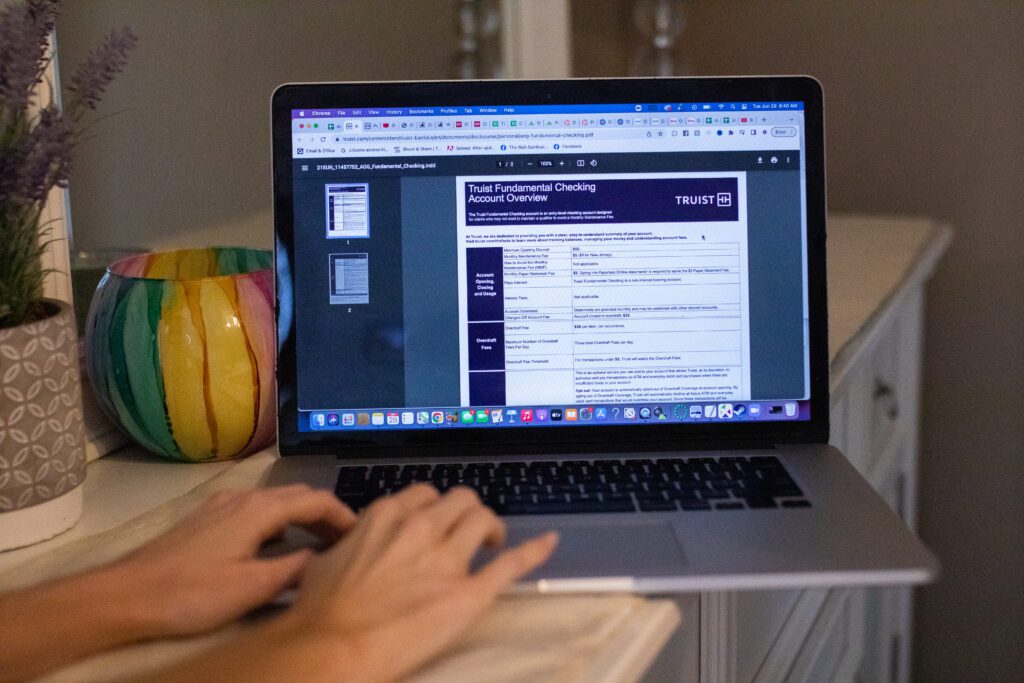

Truist has eliminated overdraft fees on its flagship Truist One Checking account. Some other account types (particularly legacy accounts from BB&T or SunTrust that haven’t been migrated to Truist One Checking) charge $36 per overdraft transaction with a limit of three transactions a day. If you make a purchase or ATM withdrawal for less than $5, you won’t be charged any overdraft fees.

The maximum you can spend on overdraft fees is $108 a day. Truist used to charge an additional $12.50 fee for transferring funds from a linked account to an account with a negative balance. This fee was for customers enrolled in the overdraft protection program. This service is now available for free. Truist has eliminated its extended overdraft fee, which was previously $30.

WAIT! High overdraft fees aren't the only way Truist Bank is costing you money.

With inflation overheating, you've probably heard that interest rates are climbing sharply. That means that for the first time in years, it's a great time to shop around for a high interest savings account.

Truist Bank savings accounts currently pay just 0.01% APY1 as of 11/22/2022. That means that if you have $2,500 in a savings account, you'd earn just $0.25 after one year! Move those hard-earned savings to an FDIC-insured bank paying 3.50% APY and you'd earn $87.49 after one year, and some banks now pay even higher rates!

Don't let your hard-earned savings sit there doing next to nothing. Check out the rates that you can earn at other banks:

How Much is Your Truist Overdraft Limit?

The amount that Truist will let you withdraw or spend once you have a negative balance is at the discretion of the bank and can vary. Truist’s overdraft limit can vary on a daily basis, depending upon your average account balance, account history, and pending transactions.

Does Truist let you overdraw your account at an ATM? It depends on whether you opted in for overdraft coverage. By default, Truist will not let you make an ATM withdrawal if you don’t have enough money in your checking account and you have reached the limit of your $100 negative balance buffer and/or overdraft protection (or if you aren’t eligible for those programs).

You’ll have to opt-in for overdraft coverage if you want to be able to pay the fee and overdraw your account using an ATM.

Need a fast $100? Here’s how you can borrow 100 bucks in a few minutes

Does Truist Charge NSF (non-sufficient funds) Fees?

Truist has eliminated NSF fees on the Truist One account; they were previously $12 per returned item. Other Truist consumer checking accounts may still be subject to NSF fees. Note that while Truist may not charge you a fee for a bounced check or payment, you still may be subject to fees and costs from the intended recipient.

Can You Get a Truist Overdraft Fee Waived?

Truist is making efforts to move toward a new banking model that does not rely on overdraft fees. Truist is not the only bank reducing fees – CapitalOne360 and Citibank have eliminated overdraft fees completely. There is a strong possibility that Truist will waive your overdraft fees to remain competitive given that major banks are no longer charging these fees.

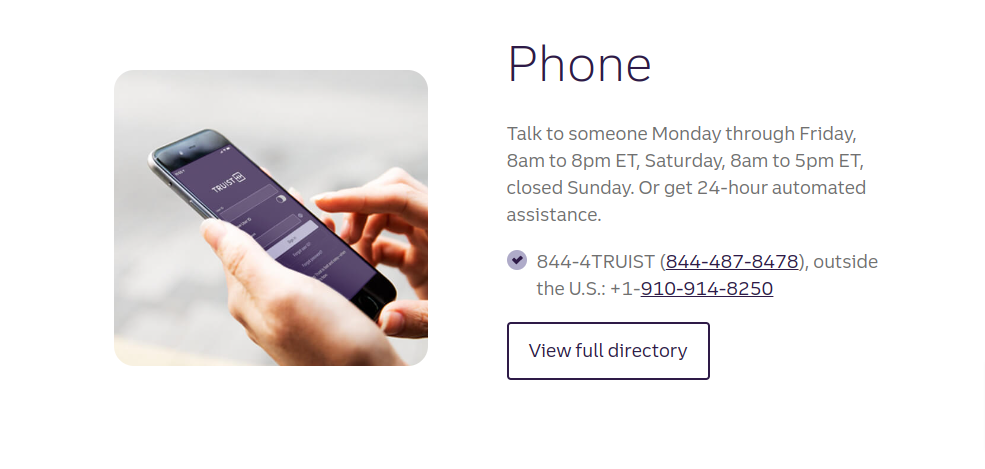

Here are a few tips to get an overdraft fee waived or ask to get an overdraft fee refund:

- Stop spending money once your account balance is negative.

- Call Truist at 844-487-8478 or find a nearby Truist branch.

- Explain your situation and ask if the customer service representative can waive the fee.

- Express your intention to make a cash deposit to cover the negative balance right away, if possible.

How To Avoid Overdraft Fees With Truist

Overdraft fees can add up. Americans spend approximately $15 billion each year on overdraft and NSF fees.

There are a few steps you can take to avoid overdraft fees.

Option #1: Sign Up For Overdraft Protection

Truist offers an optional overdraft protection program. You can opt-in when opening an account or contact customer service to sign up for an existing checking account.

With this program, you can link your account to another product like a credit card, money market account, or another checking account. If you spend more than what’s in your account, Truist will transfer money from another of your protector account to cover the difference.

Option #2: Use a No-Fee Overdraft App

You can explore options outside of what your financial institution offers. No-fee overdraft apps are a great way to cover unexpected expenses with no additional fees. Here are a couple of our favorite options:

Chime’s SpotMe is an excellent example. You can enroll for free and receive an advance of $20 to $200 as long as you set up a monthly direct deposit of at least $200. This app is a convenient tool for managing your finances. For instance, let’s say you go out for a friend’s birthday and end up spending more than you planned on food and drinks. You pick up a bar tab of $250 but only have $175 in your account. >>>Check out Chime SpotMe here

The Albert app can also help you stay on top of your money with no interest, no fee cash advances up to $250. You can borrow up to three cash advances per pay period as long as you repay the outstanding amount. As an added bonus, new users qualify for a $150 sign-up bonus so you can get paid just for trying it out. >>>Get your $150 sign-up bonus here

With Chime’s SpotMe, you can pay the tab and use an advance to pay for a cab ride home without paying anything in overdraft fees.

However, you can only get up to $200 with this app; this is convenient for small expenses but might not meet all your financial needs.

Do you want an alternative to overdraft fees? Check out the best cash advance apps of 2022 now

Option #3: Use a Cash Advance App like PockBox to borrow up to $2,500

For larger, unforeseen expenses, a cash advance app is a better option. You can use a cash advance app to request an advance until payday. You’ll typically be given access to the funds right away and can use them to cover urgent bills and expenses.

PockBox is an excellent option. This cash advance service lets you borrow up to $2,500, which is much more than what most cash advance apps will approve. You can qualify for a cash advance even if you don’t have a good credit score, and you’ll usually get the funds by the next business day.

Borrowing money is not a long-term solution for your finances. But, a cash advance can help you get back on track and prevent late fees and other expenses from adding up if you find yourself with an unexpected bill.

Borrow up to $2,500 >>> Check Out PockBox

Watch: Truist Bank Eliminates Most Overdraft Fees

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- Brigit App Review – Fast $250 Cash Advances with No Interest or Late Fees - April 10, 2024

- Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month and Visa debit card activation. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See terms and conditions.

- Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.