Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

ARTICLE SUMMARY: The best apps for borrowing money instantly offer a high upfront limit, low (or no) mandatory fees, and don’t charge interest. Plus, there is no credit check, so you can qualify even if you’ve hit some bumps in the financial road. Need a little extra time to repay? Our favorites don’t charge late fees, either!

We downloaded and tested the 12 money borrowing apps on this list (plus over a dozen more) to make sure they passed our strict “Is It Any Good?” test. We found Dave’s $500 limit2 and $1/month membership the gold standard.

Best of all, you can get a hundred bucks for just $4 in fees – the lowest cost money borrowing app we found in our comprehensive research study!3

Read on for our full list of money borrowing apps or Check out Dave if you need $500 now 👈

We’ve rounded up the 12 best apps that let you borrow money instantly against your earned or future wages.

Even better, many of the borrowing apps on our list are made for those with poor credit – so don’t stress if your credit score is lower than you’d like. You can qualify with no credit check, and you’re not going to get slammed with those sky-high fees and interest rates.

Most of these apps don’t perform a credit check, and instead do a quick and secure analysis of your bank account to look at things like your account history, your average balance, and most importantly, your deposit activity.

These money lending apps LOVE to see regular recurring deposits from your job, gig work, or government benefits like Social Security. Some of these apps will even let you borrow if you’re unemployed!

If you have a well established bank account and get paid regularly, you’ll have the best odds of qualifying for high borrowing limits right out of the gate. But don’t worry if you’re not there yet. Most of these apps can also give you a path to start small and quickly demonstrate that you’re responsible enough to handle larger limits.

So whether you need to borrow money instantly to cover urgent expenses like gas or groceries, or just want to buy something fun before your next paycheck arrives, these 12 money borrowing apps all stood out in our hands-on testing and rigorous review of their features and fees.

#1 – Dave: Use ExtraCash™ to get up to $500 in minutes with no interest and no credit check

While a lot of apps claim that you can get cash instantly, there’s often a lot of BUTs to get through first.

Some apps require your account to be 30 days old before you can borrow anything, or they start you off with limits that are so low ($5 anyone?) that they seem like a complete waste of time.

And of course, some apps that let you borrow money right away happily charge you a small fortune for the privilege.

So it’s pretty special when you find an app that lives up to its lofty promises.

Dave is one of the most widely used borrowing apps, and our number pick for when you need to get money fast.

In our hands-on tests of Dave, we’ve gotten cash in our account less than ten minutes after downloading the app. And while many apps are getting more expensive, Dave just unveiled new pricing that makes it one of the cheapest ways to borrow a quick hundred bucks!

Dave charges an express delivery fee based on how much money you advance with ExtraCash™. Express delivery fees vary:

- 3% ($3.00 minimum) for instant transfers to a Dave Spending account

- 5% ($5.00 minimum) for instant transfers to an external debit card

If you’re not in a rush, you can have Dave transfer your cash advance to your bank account within three business days via ACH (electronic transfer) with no express fee.

The only fee you can’t avoid is Dave’s monthly subscription. This costs $1 per month, which unlocks access to cash advances plus some additional features. Dave asks for tips, but these are optional and leaving a small tip or no tip won’t impact how much you can access via ExtraCash.

And you know what’s even better than getting money fast? Borrowing money cheaply!

Instantly access $100 of ExtraCash via your Dave Spending account, and you’ll pay just a $3 express fee (plus the $1 monthly subscription). Yup, just four bucks, making Dave is one of the cheapest ways to borrow $100.

Your advance will be automatically repaid when you receive your next paycheck, but if you happen to need some extra time, Dave won’t charge you a late fee. Once your advance has been repaid, you’re free to borrow again.

Dave can even give you access to your paycheck two days early, too!4

| 🤓 Overdraft Apps Tip: Gig workers can use Dave to borrow up to the full $500 limit without worrying about their fluctuating income. Check out our ‘Cash Advance for Gig Workers’ Guide for the full details. |

Get up to $500 instantly >>> Check out Dave 👈

#2 – Earnin: Borrow up to $750 with no mandatory fees

Earnin lets you borrow $100 of your pay per day and up to $750 of your pay per pay period with no fees.5

While some apps start you off with tiny borrowing limits, you can get access to the full $100 daily maximum as soon as you sign up if you have qualified earnings from your employer or side hustle – meaning that you’ve worked but haven’t yet been paid. The Earnin app connects to your employer’s payroll service when you sign up to automatically determine what you qualify for. There’s no credit check, and you don’t need to set up direct deposit. And if you work again tomorrow, you can use Earnin to get cash then, too!

Cash is deposited into your existing bank account, usually in under 30 minutes, so you can use it however you like. There is a small Lightening Speed fee of up to $4.99 to get your cash right away, though there is no fee on your first advance so you can give it a try.6 Your advance will be automatically repaid when you receive your next paycheck, and you can use Earnin to cash out again whenever you need to.

There is no subscription or any mandatory fees. Earnin recommends tipping what you think is fair, but whether you tip or not won’t impact your ability to borrow in the future.

Get up to $100 of your pay, today >>> Check out Earnin

#3 – PockBox: When you need to borrow up to $2,500 (fast!)

If you need more cash than most cash advance apps offer, PockBox is a great way to see how much you can borrow without downloading a half dozen apps that lend you money.

Answer a few quick questions, and PockBox will instantly fetch loan quotes from up to 50 lenders, so you can find the offer that works best for you.

Loans start at $100, and you may be able to borrow up to $2,500. With most lenders, you can get your loan by the next business day, and sometimes even faster.

PockBox is free to use, and there’s no obligation. Many lenders on PockBox specialize in borrowers with bad credit, so even if you’ve been turned down elsewhere, you may still qualify for a loan.

Compare loan offers for up to $2,500 >>> Check out the free PockBox app 👈

#4 – MoneyLion: Use Instacash for up to $500 cash advances

So far, we’ve talked about money lending apps like Dave and Albert that can get you quick cash when you need it, but they also chuck yet another monthly subscription fee onto your list of expenses.

If you’re tired of combing through your monthly statements to discover all of those odds and ends you forgot that you’re still paying for, then you’ll want to check out MoneyLion.

MoneyLion’s InstacashSM is cash advance service offered by MoneyLion that can let you borrow up to $500 with no credit check, no interest, and no monthly fee.7

To request an advance, download the MoneyLion app and link a qualifying checking account, then find out if you’re eligible within moments.

- To start off, you’ll unlock $10 or more. (We qualified for $150 our first time using the app.)

- With recurring deposits in your linked account, you’ll increase your limit to $50 and up to $500. (It usually takes 3 – 8 weeks of activity to reach the maximum limit.)

- Link your RoarMoney account (MoneyLion’s $1/month online checking account with a ton of perks) with recurring direct deposits to unlock up to $1,000 in Instacash. 8

If you don’t mind waiting, MoneyLion can get your cash in 48 hours for free. If you need your money faster, you can have it almost instantly by paying an express fee.

Express fees range from $0.49 to $8.99 depending on how much you borrow and whether you send it to an external or RoarMoney account.

Get cash advances up to $500 with no interest >>> Check out MoneyLion 👈

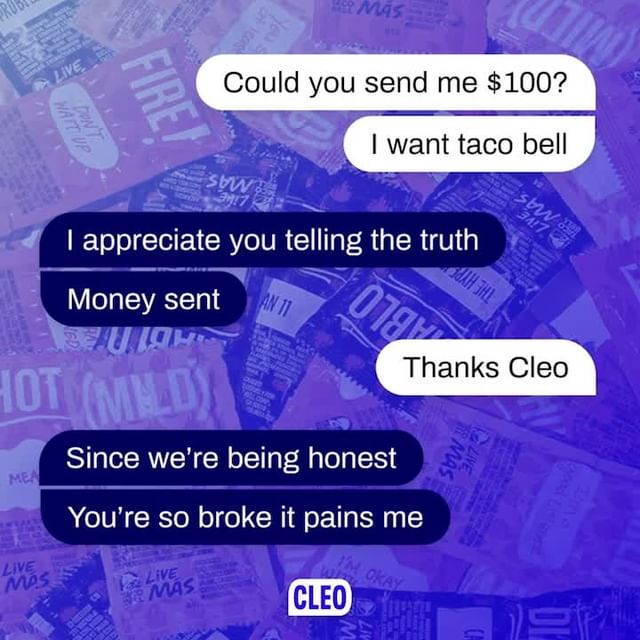

#5 – Cleo: Borrow up to $250 with a side-order of comedy

You know how talking about your finances can be so boring that your eyelids start getting heavy and you find yourself daydreaming about exciting stuff, like doing laundry?

Yeah, Cleo’s not like that.

Cleo is an AI-powered app that offers no-interest cash advances for up to $250.9, plus personalized financial advice that will friggin’ crack you up. (Well, Cleo may not say friggin’ – she’s got a bit of a potty mouth! 🚽)

Cleo uses artificial intelligence – plus hilarious memes, wisecracks and even the occasional yo mama joke – to get you to pay attention to your finances. (No joke – she’s pretty funny!) The app helps you track your spending, save automatically, and even earn cash-back rewards.

You can qualify to borrow up to $100 as soon as you download Cleo, and your limit can quickly increase to up to $250 as you build up a track record of on-time repayments and ongoing regular deposits in your bank account.

Once approved, Cleo will send funds directly to your linked bank account. Funds typically take 3 – 4 business days to land in your bank account. However, if you want instant funds, you can simply pay a $3.99 express fee to get your money within 24 hours.

| 🤓 Overdraft Apps Tip: There is no interest, no credit check, and – importantly – no need to submit timesheets to use Cleo. This makes Cleo a great option for a range of freelancers, whether you deliver for DoorDash, drive for Uber, or shop on Instacart. |

Get Started in 2 Minutes (And Borrow up to $250) >>> Check Out Cleo’s Sass 👈

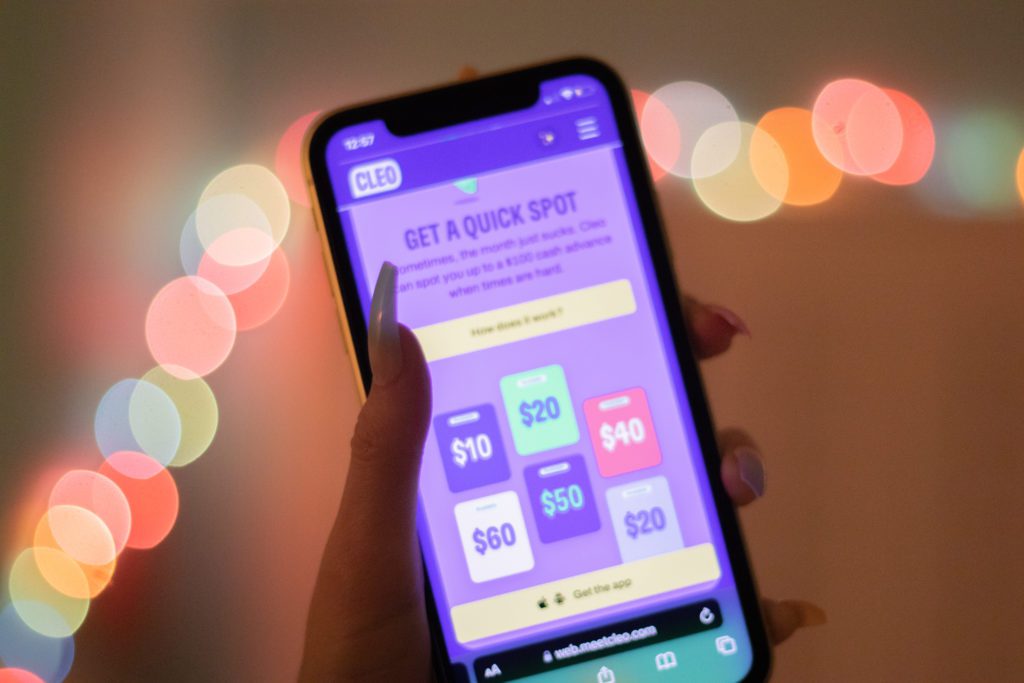

#6 – Brigit: Use ‘Instant Cash’ to borrow up to $250 in fee-free overdrafts

Brigit offers instant cash advances between $50 and $250 per pay period.10 With more than 4 million downloads, you’ll often find Brigit ranking on the App Store and Google Play as one of the most popular money borrowing apps.

Most people qualify for advances between $50 and $100 – with your specific amount based on your bank account history and activity, especially those (you guessed it) regularly recurring deposits.

Unlike some other money lending apps on this list, you’ll need to pay for Brigit Plus to unlock cash advances. This costs $9.99/month. Or, you can upgrade to Brigit Premium for $14.99/month to unlock advances and free express delivery.

Brigit’s $9.99/month fee is more than apps like Dave ($1/month) but (a lot) lower than the late fees you might be charged if you’re short on cash.

Subscribing for Brigit Plus also unlocks the ‘Auto Advance’ feature. This uses Brigit’s algorithm to predict when you may run low on funds and automatically covers you to avoid an unwanted overdraft.

Access up to $250 in fee-free overdrafts >>> Explore Brigit Now 👈

#7 – Chime SpotMe: Borrow $20 right away (up to $200) with no overdraft fees

Chime SpotMe® can provide you with up to $200 in fee-free overdrafts.11

Set up a direct deposit to be eligible for the SpotMe feature. Once you set up your account to receive a qualifying direct deposit of $200 or more a month, Chime will cover up to $200 in overdrafts on your account.

You can overdraft your account via debit card purchases or ATM withdrawals with no overdraft fees (limits start at $20).

You won’t find super high limits with SpotMe. But you can see how much you can overdraft in the Chime app to avoid the dreaded declined transaction.

Get fast access to fee-free overdrafts >>> Sign up for Chime in less than 2 minutes 👈

#8 – Klover: Borrow up to $200 in as little as 10 minutes

The Klover app can quickly advance you up to $200 – even if your payday is two weeks away!

There’s no credit check to apply and you’ll enjoy some of the lowest fees of any cash advance app on this list.

Klover will connect to your bank account via Plaid and analyze your latest transactions. In (totally NOT) surprising news, recurring deposits are typically the key criteria to scoring a cash advance.

Most users will need at least three recent deposits of at least $250 from the same employer and at a consistent interval – for example, weekly or fortnightly. Klover’s cash advance (called a ‘Boost’) does have stricter criteria so it may not be the best fit if you’re a freelancer or gig worker with multiple income streams.

If you qualify, the Klover app will immediately let you know your cash advance limit. As a new user, you’re likely looking at less than $200. But a history of repaying your ‘Boosts’ on time can help increase your limit.

Get up to $200 Now From Klover >>> Check Out Klover 👈

#9 – Current: Borrow up to $200 with fee-free overdrafts

Current Overdrive gives you up to $200 in no-fee overdrafts in debit card purchases with no interest, fees or credit check.12

Signing up for Current also gives you a Current debit card, which you can use at millions of merchants or withdraw cash from nearly 40,000 ATMs with no fee.

You can also cash checks right in the app and even earn rich cash-back rewards when using your debit card, such as 4% at tons of local and national restaurants and 2% back at brand-name gas stations.

According to Certified Financial Education Instructor and founder of Money For The Mamas, Kari Lorz, these additional features can turn a good money-borrowing app into a GREAT one. She explains…

“You should look for a cash advance app that has other features, like budgeting & saving tools. Both Albert & Current offer great budgeting features. Current even offers Savings Pods, so you can save for multiple things at a time (even earning 4.00% APY on your savings)! You can have an emergency fund, save for your kiddo’s braces, and save for a weekend getaway! These pods are kept separate, so you never mix up what money is for what purpose.”

As long as you make qualifying direct deposits to your Current account, Overdrive will kick in whenever you need it, so you can avoid declined transactions.

Get up to $200 whenever you need it >>> Check out the free Current app 👈

#10 – Albert: Tap ‘Albert Instant’ to borrow up to $250… instantly

Albert offers a great set of tools to manage and better understand your money, including the ability to get up to $250 in minutes, with just a few taps through Albert Instant.13

When you get started with Albert, you’ll get an Albert debit card (a virtual one that you can use right away will be created as soon as you sign up, and a physical one will arrive in the mail a week or so later.

You can use this debit card to access some pretty handy features, including the ability to access your paycheck two days early (with direct deposit) and earn cashback rewards on common purchases Ipretty rare for a debit card!)

Of course you can also use your Albert debit card to load up extra cash when you’re in a bind, and access it for purchases and no-fee ATM withdrawals at over 55,000 locations.14.

Instant limits start at $10 and can go up to $250 with no credit check. Your ‘Albert Instant’ limit is based on a variety of factors, including:

- Account activity: Active bank account linked to Albert

- Transaction history: Account with a long transaction history linked to Albert

- Direct deposit: Qualifying direct deposits with Albert Cash can potentially raise your Instant limit

You’ll need to subscribe to Albert to access extra cash, and you can use Albert Instant up to three times per pay period – most other apps limit you to just once.

Your subscription also gives you access to Albert Genius, where real (human!) financial experts can give you personalized advice about creating a budget, improving your credit score, paying down debt, and more.

Albert Genius costs $14.99 per month, but you get it free for the first 30 days. (It can be a little tricky, so here’s a quick video that shows how to cancel your Albert subscription.)

The other fee to note is that If you want to send funds to your linked bank account instantly (less than five minutes in our tests), there’s an optional $6.99 express fee. or, you can send money to your bank account in three days with no fee.

#11 – B9: App that lends you up to $500 of your wages early

B9 offers instant advances on your paycheck up to $500.

As a membership-based cash advance, B9 comes with just ONE fee with no express fees, optional tips, or late fees.

Choose between two membership options.

- Basic: $9.99 per month for advances up to $100

- Premium: $19.99 per month for advances up to $500

You can apply for a B9 cash advance after your employer has deposited at least ONE paycheck into your B9 account. The amount you’re eligible to borrow will be based on your account history, payroll direct deposit frequency and amount, and other factors that may change from time to time – according to B9’s terms of service.

A handy addition for gig workers, B9 considers income from multiple streams. You could drive for Uber on the side of your full-time job, receive government benefits, make money online, or do any other side hustle – and B9 acknowledges your income!

Access up to $500 of your wages early >>> Check out B9 👈

#12 – Empower: Get instant cash advances up to $250 but watch out for fees

Empower lets you borrow up to $250 with 0% interest, no late fees, no credit check, and a flexible repayment date.

Empower considers your income, your spending habits, and any recurring bills to determine your borrowing limit. New users can be approved for an initial amount of $75 – a significant increase compared to other money lending apps like Cleo and Grid Money, which typically offer limits between $20 and $50 initially.

Once approved, you can choose to have your Empower cash advance deposited into your bank account within minutes (Empower claims 98% of advances land in external accounts within 15 minutes).

Empower lets you ‘Try Before You Buy’ with a 14-day free trial for first-time customers. After the trial period ends, you will be billed an $8 monthly subscription fee, which is lower than the fees charged by apps like Brigit ($9.99/month) and B9 ($9.99 – $19.99/month). But watch out – add in high express fees and get cajoled to leave tip, and you’ll see why we found Empower to be one of the costlier apps that lend you money.

| 🤓 Overdraft Apps Tips: We analyzed the costs of borrowing $100 from the 15 most popular cash advance apps and found that the average cost is $19.08 Empower was one of the most expensive option out of all 16 apps, costing $28 to borrow $100 (including recommended tip)! |

Enjoy up to $250 of your wages early >>> Check out Empower 👈

What apps let you borrow cash instantly?

As long as you meet the eligibility requirements, you can get your cash in as little as a few minutes – or as long as a few days – depending on whether you pay an express fee or wait for your free cash advance.

For example, an Albert Cash Advance of $100 can be yours in minutes if you’re OK with paying a $6.99 express fee. Or, skip the fee and wait 2 – 3 business days instead.

| App | Express Fee Get Your $$$ Instantly | Free Cash No Fees, Not Instant |

|---|---|---|

| Albert | $6.99 | 2 – 3 business days |

| B9 | N/A | under 30 minutes |

| MoneyLion (external account) | $4.99 | 3 – 5 business days |

| MoneyLion (RoarMoney account) | $3.99 | 24 – 48 hours |

| PockBox | N/A | As little as 1 business day |

| Cleo | $3.99 | 3 – 4 business days |

| Dave | 3% (Dave Spending Account) or 5% (external bank account | under 30 minutes |

| Brigit | N/A | 1 – 3 business days |

| SeedFi | N/A | 1 – 2 business days |

| Earnin | $0.99 – $3.99 | 1 – 2 business days |

| Empower | $1 – $3 | 1 business day |

| Klover | $2.99 – $12.99 | Up to 3 business days |

Bottom line: The best money borrowing app is…

The one that meets your needs, budget and goals.

U.S. Household debt rose to $17.06 trillion in 2023. The quick approval times and flexible borrowing limits of many cash advance apps can help reduce some of the pressure.

We reached out to certified financial planner Alex Williams for final advice on the most valuable app features to look for. He says…

“Repayment flexibility is the feature that offers the most value to cash advance app users. It will accommodate individuals if they have issues repaying the loan by extending the return date”.

If you’re strapped for cash heading into 2024, the apps we’ve listed here can help remove the pressure of unpaid bills and expenses with fast and hassle-free advances.

Remember to carefully review the terms, conditions, and fees of the app you choose, and you’ll have all the information you need to make an informed choice and get the money you need.

BEFORE YOU GO… Check out our most popular articles:

- Need More Cash? Check out these $500 instant loan apps 💎

- Easy way to build your credit for just $5/month 💎

- Quick and Easy Ways to Withdraw Cash from the ATM (When You Have None) 💎

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- ExtraCash™ is a DDA account with overdraft utility, advances are subject to eligibility requirements and identity verification. Taking an ExtraCash™ advance will make your account balance negative. Express delivery fees apply to instant transfers. As of January 18, 2023, most customers receive an advance of $160 or more. See the ExtraCash™ Account Agreement for more details.

- Based on a $1/month subscription fee, $3 optional Express fee to transfer your $100 to a Dave Spending account, and no optional tip.

- Early access to direct deposit funds depends on timing and availability of the payroll files sent from your employer. These funds can be made available up to 2 days in advance.

- Subject to your available earnings, Daily Max and Pay Period Max. EarnIn does not charge interest on Cash Outs.

- Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank connection. Restrictions and/or third party fees may apply, see Earnin.com/TOS for details.

- Instacash is an optional service offered by MoneyLion. Your available Instacash Advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. See Instacash Terms and Conditions for more information and eligibility requirements.

- MoneyLion is a financial technology company, not a bank. RoarMoneySM demand deposit account provided by, and MoneyLion Debit Mastercard® issued by, Pathward®, National Association, Member FDIC. RoarMoney is a service mark of MoneyLion. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds are FDIC insured, subject to applicable limitations and restrictions, when we receive the funds deposited to your account.

- Cleo Plus is our subscription service, which offers eligible users cashback on your money, information on your credit score, and access to cash advances (“Cash Advance”). Advance amounts will vary based on eligibility. If you don’t want to subscribe, you can also apply for cash advance by contacting our customer service at [email protected]. To learn more about eligibility, repayment, and overall terms, please visit: meetcleo.com/terms

- Not all members will qualify for advances; Depending on eligibility, advances range from $50 – $250. Subject to Brigit’s approval and policies. Express Delivery is optional and a fee may apply. Most users receive their Express Delivery within 20 minutes. Brigit monthly subscription required.

- Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. SpotMe® on Credit is an optional, no interest / no fee overdraft line of credit tied to the Secured Deposit Account available to qualifying members with an active Chime Credit Builder Account. SpotMe on Debit is an optional, no fee overdraft service attached to the Chime Checking Account available to qualifying members after Visa debit card activation. Both SpotMe on Credit and SpotMe on Debit are sometimes collectively referred to as “SpotMe” or, if you have signed up to use SpotMe with only one account, “SpotMe” means the elected service. To qualify for SpotMe, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account each month.

- Current is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. Cryptocurrency services are not provided by Choice Financial Group or Cross River Bank, and cryptocurrency is not insured by or subject to the protections of the FDIC. The Current Visa Debit Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. The Current Visa® secured charge card is issued by Cross River Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see back of your Card for its issuing bank. Current Individual Account required to apply for the Current Visa® secured charge card. Independent approval required. Please refer to Fee-free Overdraft Terms and Conditions. Individual Current Accounts only.

- Albert is not a bank. Banking services provided by Sutton Bank, Member FDIC. Instant overdraft eligibility requirements, limits, and other terms apply. Limits start at $10 and may be increased up to $250 by Albert. A qualifying Genius subscription is required to access Instant overdrafts. Transfer, ATM, and other applicable fees may apply. See app for details.

- ATM withdrawals are fee-free for Genius subscribers at 55,000+ AllPoint ATMs. Fees may apply for non-subscribers and out-of-network ATM withdrawals.