Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

Banks will collect more than $15 billion in overdraft fees this year.

Billion.

Worse still, roughly 9% of people who overdraft are responsible for 80% of fees. So whether you’re managing a household where overdrafts are a frequent monthly occurrence or you’re looking to improve your personal money management, it’s important you know how to pay your bills and cover important transactions without the fees.

That’s where Current Overdrive can help.

Read on to find out how how you can overdraft via Current’s Overdrive feature to access up to $200 for debit card purchases, without paying any overdraft fees.2 Plus, discover some of the other incredible benefits of using Current, including early access to your paycheck and how you can get paid for using your Current debit card!

Access $200 in no-fee overdrafts >>> Check out Current

What is Current?

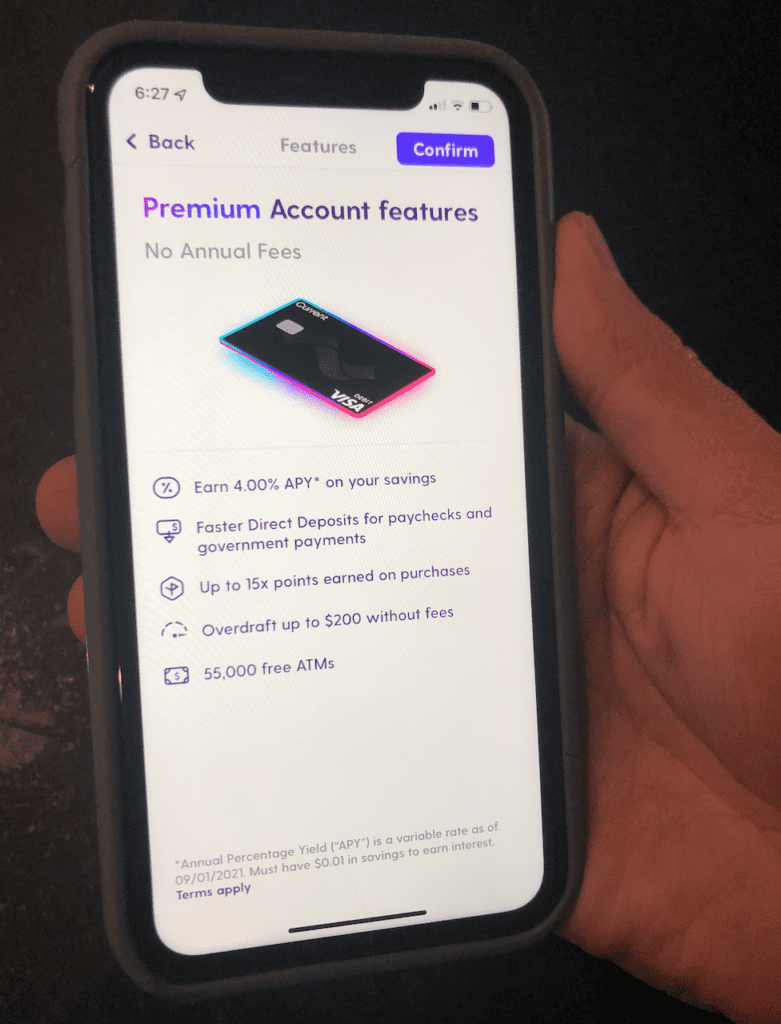

Current is a financial app that gives you nearly all of the features of a bank right from your phone, and most of then are available with no fees!3

Founded in 2015 and headquartered in New York, United States, Current’s mission is to enable its 3 million+ members to change their lives by creating better financial outcomes. As one of a growing number of fintech companies, Current offers alternatives to traditional banking – and alternative to costly overdrafts.

One of Current’s top features is Overdrive. This allows you to access up to $200 in overdrafts to cover unexpected expenses and bills without charging overdraft fees.

Having shielded customers from over $100 million in overdraft fees, Current proudly offers a range of services at no charge with advantages that include:

- Zero overdraft fees (ever)

- No ATM fees at over 40,000 in-network ATMs

- Get paid up to 2 days early with faster direct deposits

- No minimum balance fees, bank transfer fees, or hidden fees.

- Earn up to 15x points towards cash back rewards with 14,000 participating merchants nationwide.

Access $200 in no-fee overdrafts >>> Check out Current

How to overdraft your Current card with Overdrive

Current Overdrive can provide you with up to $200 in fee-free overdrafts via Current debit card purchases.

To qualify for Overdrive, you must:

- Have an active Current account in good standing

- Receive at least $500 in qualified direct deposits in your Current account over each 30-day period

- Be 18 years of age or older (Under 18? Check out these debit cards for teens.)

Current’s overdraft limits start at $25 and can be increased up to $200 by Current based on a variety of factors, including account activity like swiping your Current Debit Card.

Here’s an example of how you can use Overdrive to overdraft your Current card to help cover expenses, even when your checking account is empty:

You’re heading out for birthday drinks with your best friend. A round of drinks costs $25 but your account balance is at $0. When you pay with your Current debit card, you won’t have the embarrassment of seeing your transaction declined. Instead, Overdrive will cover the difference up to your limit, send you a push notification to keep you updated, then the next deposit into your Current account will clear your negative account balance.

Best of all, there’s no cost or additional fee for using Overdrive. As a qualifying Premium member, you can swipe your card without worry knowing your urgent expenses or bills are covered even if you’re low on funds – without being charged overdraft fees.

Current Overdrive doesn’t have sky-high overdraft limits (you can overdraft $25 right away, and your limit can be increased to up to $200). But it can help you cover emergency expenses with helpful notifications alerting you to how much of your Current overdraft has been advanced and how much remains.

>>> Sign up for Overdrive in less than 2 minutes to say goodbye to overdraft fees.

How to overdraft your Current card on purpose

With your Current Visa debit card, you have a financial safety net in your back pocket.

Once you open your Current account, you’ll receive your debit card. If your account qualifies for Overdrive, you’ll receive a notification letting you know the fee-free overdraft feature has been enabled. Once you choose to enable this feature you can check your overdraft limit by tapping ‘Overdraft Protection’ in the ‘You’ section of your Current account.

Better still, Current provides a virtual debit card so you can add it to your virtual phone wallet and start using it ASAP. This means you won’t be stuck without the funds you need while you wait 7-10 days for your physical Current debit card.

Current’s overdraft limits start at $25 but can be increased to $200. The more you use your account and meet the qualifications for Overdrive, the more your limit will increase. Making life easy, you don’t need to do a thing throughout the process. Current will periodically review your account and let you know via email when your limit has been increased.

Best of all, Current’s push notifications keep you on top of your money. Big banks commonly hide your account balance and sting you with overdraft fees of $35 or more. Current will let you know every time Overdrive has covered a purchase so you know exactly how much you have left before you hit your limit.

Access $200 in no-fee overdrafts >>> Check out Current

Can you you overdraft your Current card at an ATM?

Overdrive works with in-store or online transactions made with your Current debit card, so like most finance apps, Current does not let you overdraft at an ATM or for ACH or peer-to-peer payments payments (including payment apps like Venmo, Dave, or Square Cash).

However, Current does come with a pretty awesome feature that can get you access to the funds you need. Set up direct deposit of your paycheck to Current, and you’ll get paid two days faster! It’s often those last few days before payday when money can sometimes get a little tight, so Current can help you avoid the end-of-month squeeze by giving you early access to your paycheck. There’s no fee for this service and nothing to set up; Current will automatically post your paycheck two days early to your account when you set up a qualifying direct deposit.

If you’re still looking for alternatives that let you withdraw cash from an ATM when your account is in overdraft, check out:

- PockBox (cash advance up to $2,500)

- Albert (no-fee cash advances for up to $250)

- Cleo (no-fee $100 cash advances and sassy financial advice you might actually listen to)

- Chime Spotme (get up to $200 in fee-free overdrafts)

- Go2Bank (Second chance bank account with up to $200 in overdrafts)

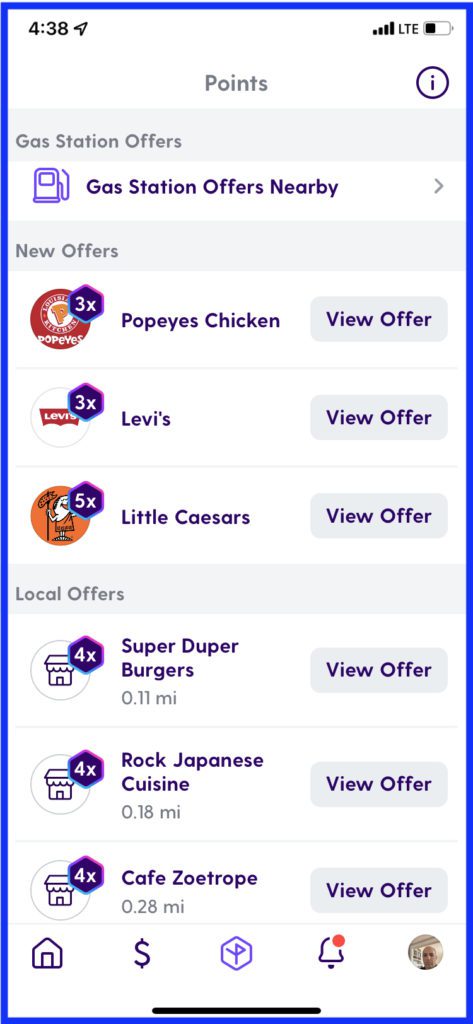

Get cash back rewards on your Current debit card

We’ve already mentioned how Current gives you access to overdrafts and ATM withdrawals with no fees – and there’s no minimum balance requirement or fee – but there’s one more amazing feature of Current that’s hard to find anywhere else. You can get paid for using your Current card.

It’s tough to find a debit card that offers cash-back rewards, and Current not only offers them, in many cases it offers more points than those rewards credit cards with sky-high annual fees! Of course your favorite restaurant chains and retailers are there, like Forever21 and Burger King, and so are tons of local restaurants, many of which currently offer points redeemable for 4% cash back when you pay with your Current debit card.

And if record-setting gas prices have you Shell-shocked (get it?), you’ll love to hear that Current offers 1% – 2% in cash-back points at many gas stations, including the big national brands. Those savings can add up quickly when a fill-up costs nearly $100 in some parts of the country!

Access $200 in no-fee overdrafts >>> Check out Current

Final thoughts and what to do next…

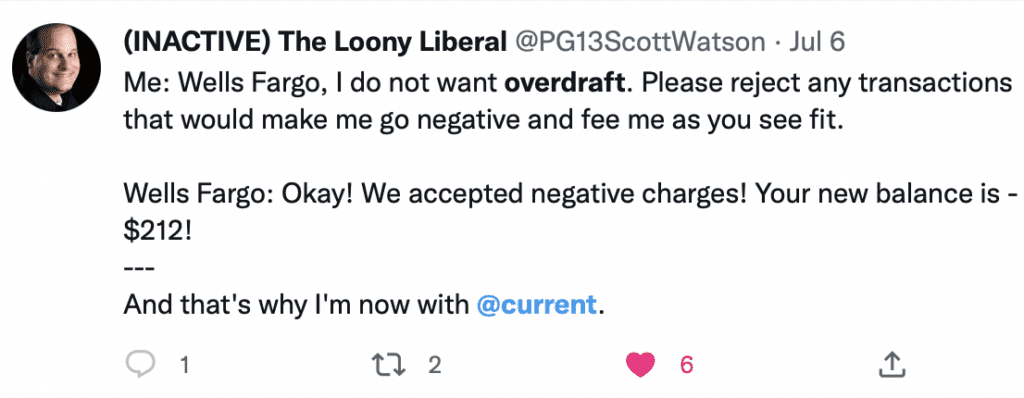

As a digital-only app, Current is making banking easier for millions of Americans who don’t always have the funds they need to stay on top of expenses. But who don’t want to be punished with sky-high overdraft fees to cover purchases.

Signing up for Current is easy (and takes less than 2 minutes). So if you’re ready to ditch your expensive dinosaur bank take advantage of fee-free Current overdrafts, early payday and cash-back rewards on your debit card purchases, Current might just be the best choice for you.

Looking for other ways to get $200? Here’s where you can borrow $200 FAST ⚡

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- Cleo App Review – $250 Cash Advances and Wiseass AI Money Management - April 24, 2024

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- Overdrive™ is available only on Current Individual Accounts and requires $500 in qualifying direct deposits on Current each month. Members will be notified by Current when they are eligible and must opt-in to Overdrive™. The Overdrive™ limit starts at $25, allowing members to overdraft their accounts up to $25 on debit card purchases without any fees, and accounts are reviewed periodically for increases up to $200 at Current’s discretion. Your limit may change based on your account history, spending activity, or other risk-based factors. You will receive a notification of any changes to your limit and your limit may change at any time at Current’s discretion. Your limit and remaining balance will be displayed to you in the Current app. When you receive your next deposit, Current then will apply funds towards your negative balance. Overdrive™ will not cover any non-debit card purchases, including ATM withdrawals, ACH transfers, P2P services (PayPal, Venmo, Cash App, or similar services), Current Pay transfers and checks. See terms and conditions.

- Current is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC. The Current Visa Debit Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.