Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

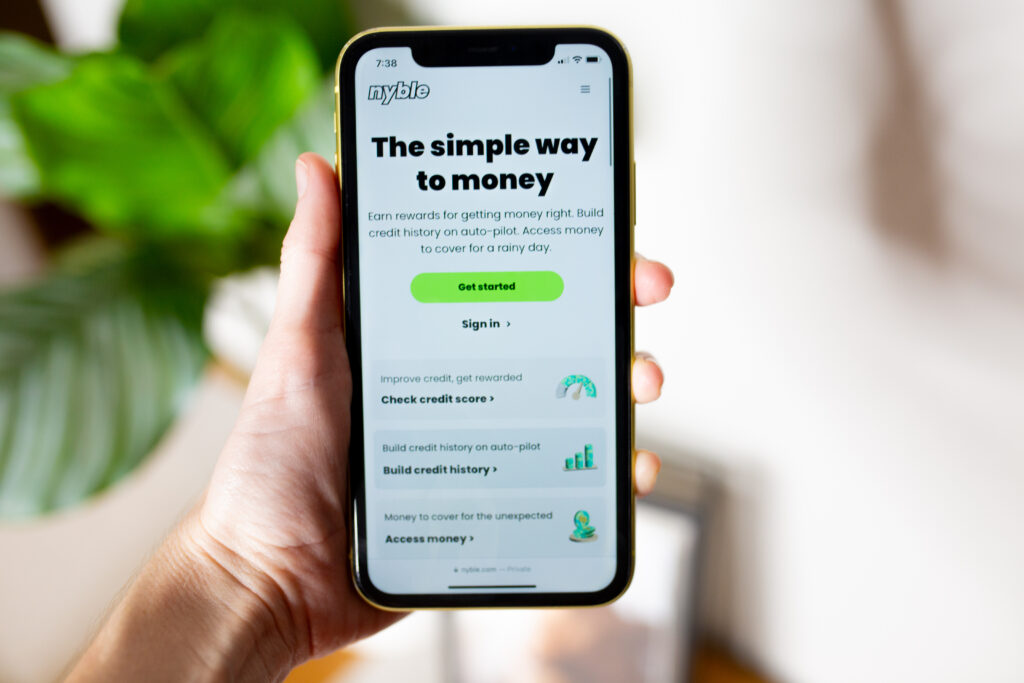

30-SECOND SUMMARY: Nyble is on a mission to help Canadians build their financial future with cover up to $150 for unexpected bills, credit score monitoring and credit building help, plus rewards for good money habits. Nyble isn’t free though and membership fees range from $4.99 to $11.99 depending on your membership type. Is Nyble the right app for you? Read on to find out.

Get up to $150 in five minutes >>> Check out Nyble

What is the Nyble app?

Nyble, founded in 2022, offers a small line of credit between $30 and $150 to help you get through until your next payday.

With the Nyble app, you can cover unexpected expenses and then pay back your small loan when your next paycheck arrives.

Odds are you’re already low on cash if you’ve got your eye on Nyble, so it’s helpful to know there are no credit checks to get started and no interest fees or late fees to stress about.

There is a 14 day free trial for first-time customers. After your trial ends, you’ll need to pay Nyble’s $4.99 – $7.99 per month membership fee to be eligible for a line of credit (and membership does not guarantee access to your own line of credit).

This is on the high side of membership fees compared to an app like Bree ($2.99) and KOHO ($5).

To be approved for Nyble’s line of credit, you’ll need:

- Employment or Government income

- Canadian bank account with your payroll/income deposits

- Monthly recurring deposits and a history of regular deposits

Other Canadian online banking apps set your overdraft protection based on account history and won’t do a hard or soft credit pull.

Nyble is slightly different.

There is no hard or soft credit enquiry when you apply for a line of credit. Nyble will assess your employment income and the number of NSF transactions on your account.

If approved, Nyble WILL then report payments (both on time and missed) to the credit bureaus.

So you don’t have to worry about your credit score to get started. But your credit score may be affected as you use Nyble’s credit line.

Get up to $150 in five minutes >>> Check out Nyble

How does Nyble’s overdraft line of credit work?

Sign up for an account, add in your personal information, and connect your bank account to Nyble.

Once you’re up and running, you can apply for an overdraft line of credit between $30 and $150 – known as Cover. Your approval amount depends on your employment status and a few other factors.

If you’re approved, funds will be in your linked bank account within three business days. If you need your money fast, you can pay an express fee between $2.99 and $5.99 to receive your money in as little as 30 minutes (but usually instant). You can use this quick cash however you like – pay for purchases or bills, withdraw cash, or avoid costly bank fees.

You can request advances as often as you like as long as the previous amount has been repaid.

How do Nyble repayments work?

Nyble reports payments to major credit bureaus, so you’ll want to make sure you’re on top of your money at all times.

The Nyble apps aims to make this easy by taking repayments on the repayment date you choose. Nyble recommends making sure you have enough funds in your account to cover your repayment. You can also log into the app whenever you like to manually repay an outstanding amount.

There are no late fees for missing your set repayment date. But your late payments may be reported to the credit bureaus.

What fees should you watch out for?

Nyble doesn’t charge interest on your line of credit or charge late fees if you’re a little slow to pay back your Cover.

But you’ll need to pay for a monthly membership to access your line of credit and there are express fees to consider if you need your money instantly (otherwise you can end up waiting for three days).

Here’s what you might pay to access a $100 line of credit.

| Nyble Line of Credit | |

|---|---|

| Loan Amount | $100 |

| Loan Term | 30 Days |

| Fees | $7.99 monthly membership fee + $5.99 express fee |

| Total Cost | $113.98 |

What other features does the Nyble app offer?

Nyble is a mobile banking app that can do more than cover your next bill.

Over multiple membership tiers, Nyble comes with plenty of features to help boost your credit and reward you for staying on top of your finances.

Here’s how Nyble can help you manage your money:

- Access your credit score instantly (without hurting your credit): Get weekly updates on your credit score and recommendations that may impact your score. No more sitting in the dark.

- Build credit score on autopilot: Nyble helps you build credit for the things in life that matter (through access to more lenders and offers) through on-time payments.

- Reward points to be redeemed for gifts or rewards from your favorite brands: Earn rewards when you check your credit score, pay off your debts, and improve your credit. Reward points can be redeemed for gift cards at stores including Starbucks, Walmart, Best Buy and Sephora.

Is the Nyble app legit?

Toronto-based app Nyble was launched in 2022 with a mission to help Canadians better manage their money.

A financial services app available in all Canadian territories and provinces, Nyble is run by Fincentify Inc., an Ontario fintech startup.

Claiming to be trusted by 50,000+ Canadians, Nyble’s website has all the Terms and Conditions and Privacy Statements you’d expect to see. There are no contact phone numbers on the website. So if you want to get in touch, you’ll have to send an email or chat with Nyble’s ‘Chat Box’ which is available Monday to Friday (9am to 5pm ET).

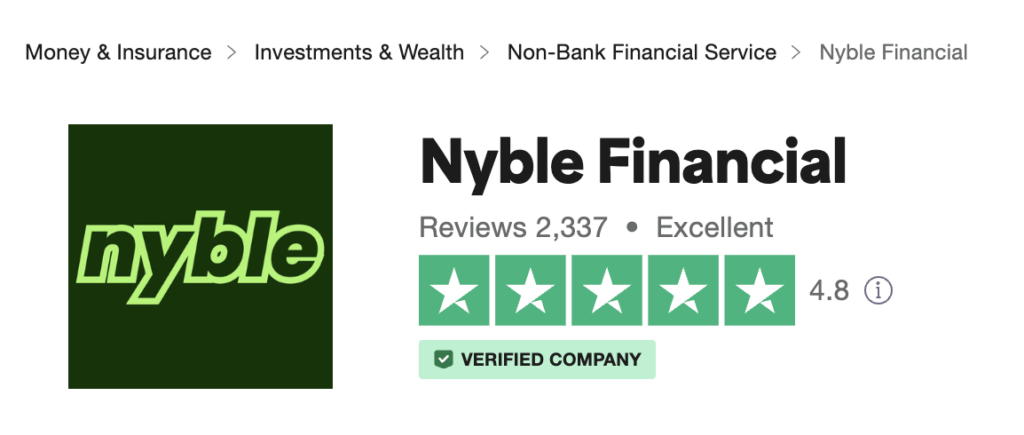

One of a new breed of Canadian financial apps, Trustpilot reviews are strong with an excellent 4.8 rating from well over 2,000 reviews.

Get up to $150 in five minutes >>> Check out Nyble

Are there other apps like Nyble in Canada?

Nyble is one of a handful of apps created to help Canadians better manage their money… though not all are identical.

- Nyble sets up an unsecured overdraft line of credit between $30 and $150.

- Bree provides overdraft coverage from $10 up to $250.

- KOHO offers overdraft protection from $50 up to $250

- Here’s how you can get an instant $50 loan 🇨🇦

BEFORE YOU GO… Check out our most popular articles:

- Best Cash Advance Apps for Gig Workers 🔥

- ATM Withdrawal Hack (When You Have Zero Cash) 🔥

- Bree Cash Advance App (Easy Money for Canadians?) 🔥

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.