Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

Go2Bank is a mobile bank account with an impressive set of features, including up to $200 in overdraft protection and access to your paycheck two days early. Meet a few simple requirements and its easy to get these benefits and more with no fees. Plus, you can get a whopping 7% cash back instantly at very popular national retailers and restaurant chains. We break it all down in our Go2Bank app review.

What is the Go2Bank App?

Go2Bank bills itself as “the ultimate mobile bank account” and with a rich set of features that you can qualify for with no monthly fees1, it’s certainly not a wild claim!

Go2Bank is amongst the new crop of ‘neobanks’ that give you easy, full-featured access to key banking services right from your phone. The Go2Bank app gives you full access to your account, and is linked to you Go2Bank debit card, making it easy to manage and access your money almost instantly. It’s no wonder that Go2Bank is one of the most popular and highly-rated personal finance apps, with a 4.7 star rating on the App Store and 4.5 on Google Play (both out of 5.0).

Though there are no Go2Bank branches, your account comes with a Visa debit card that you can use to make purchases with nearly any merchant. You can also access cash via thousands of ATMs in the Go2Bank network nationwide, with no fee. 2

Need to make a deposit? Go2Bank has Ingo Money built right in to the app, so you can cash a check in minutes at anytime and from anywhere, just by snapping a few photos of it on your phone.3 You’ll even get a $5 credit to your Go2Bank account when your cash your first check – use the code G02get5 in the app to qualify.4

And if you need to deposit cash, you can so at nearly 100,000 retail locations, including CVS, Walgreen’s and Walmart stores.

Check out the ultimate mobile bank account >>> Get started with Go2Bank

How much can you overdraft your Go2Bank debit card?

Go2Bank gives you access to up to $200 in overdraft protection5 on debit card purchases, which can come in handy when you’re a little short on cash. There is a $15 overdraft fee on overdrafts over $5, however Go2Bank will waive the fees if you bring your account back to a positive balance within 24 hours of your first overdraft transaction.

Unlike some banks that don’t share your overdraft limits, Go2Bank makes them quite clear to you and you overdraft your account right away as soon as you meet these criteria. Your Go2Bank overdraft coverage is directly tied to your direct deposit history:

- $10 after your first direct deposit

- $100 when you make two direct deposits totaling at least $200 over the past 35 days

- $200 when you make two direct deposits totaling at least $400 over the past 35 days

You’ll be automatically enrolled in the Go2Bank overdraft protection program, with overdraft limits set to match your direct deposit history. Go2Bank overdrafts are available on debit card purchases. You cannot overdraft your Go2Bank card at an ATM.

Access up to $200 in overdraft protection >>> Get started with Go2Bank

Get paid early with the Go2Bank app

Setting up direct deposit with Go2Bank also unlocks the ability access your paycheck before payday! You can tap your next paycheck two days before it arrives6, and if you receive government benefits you can access those four days before they are paid out.

This service works in a similar way to the popular payday advance apps like Dave, Earnin and Brigit, but with one big difference. There’s no fee for accessing your paycheck early with Go2Bank and you won’t be asked to leave a ‘tip’ for the service.

In fact, taking a few minutes to set up direct deposit with Go2Bank (it really is that quick and easy!) can unlock hundreds of dollars of savings a year for you. Besides early paycheck access and a 24 hour grace period on your overdrafts, Go2Bank will also waive its $5 monthly fee3.

Get your paycheck two days early >>> Get started with Go2Bank

Get up to 7% cash back instantly!

As the old tv commercials used to like to say… But wait, there’s more!

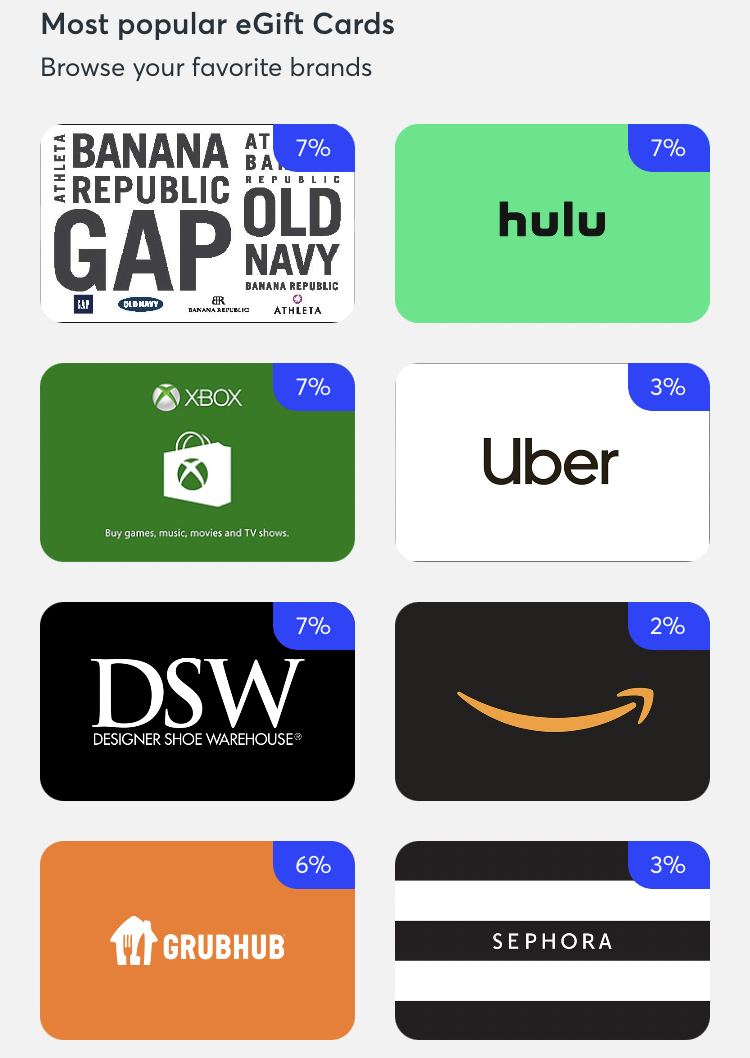

With the Go2Bank app, you can buy eGift Cards from dozens of popular stores, restaurants and online brands and get up to 7% cash back instantly7. If you’re getting ready to make a larger purchase – or just heading out to dinner with a bunch of friends or family – this can quickly put some money back in your pocket.

For example, if you’re out to dinner at a popular chain like Outback or Applebees, you can buy a $100 eGift Card through the Go2Bank app with just a few clicks and use it right away to pay the check. Plus, you’ll have $7 cash back instantly posted to your account. It’s tough to find deals like this anywhere, even on those platinum or black credit cards, and the savings can be substantial.

7% instant cash back offers

While the merchants participating in these offers may change from time to time, here is just a sampling of some of the brands currently offering 7% instant cash back on eGift Cards through Go2Bank:

Stores: Advance Auto Parts, Aeropostale, Autozone, Athleta, Banana Republic, Claire’s, The Container Store, DSW, Gap, H&M, J. Crew, Office Depot, Old Navy, Pottery Barn, REI, Sunglass Hut, Ultra, Wayfair, West Elm, Zenni, and more!

Restaurants: Applebee’s, Buffalo Wild Wings, Carrabba’s Italian Grill, Chilis, Chuck E. Cheese’s, Cold Stone Creamery, Domino’s, Five Guy’s Jamba, Jersey Mike’s, Magliano’s, Outback, Panda Express, Peet’s, Rubio’s, TGI Fridays, and more!

Entertainment: Hulu, Madden NFL 20, Nintendo eShop, Regal Cinemas, Roblox, StubHub, Top Golf, Twitch, Xbox, and more!

And here’s the big one – know how Amazon never has a storewide sale? Well, with the Go2Bank app you can buy Amazon eGift Cards and get 2% cash back. Plus, 4% instant cash back on eGift Cards for Instacart and 6% at GrubHub. It’s tough to find deals this good anywhere else!

Access tons of instant cash back offers >>> Get started with Go2Bank

Frequently Asked Questions

Is Go2Bank legit?

Yes, your money is safe with Go2Bank, which is a member of the FDIC, meaning your deposits are federally insured for up to $250,000. The Go2Bank brand is operated by Greendot, a public company that is over 20 years old and has served over 33 million customers.

Go2Bank debit cards and secured credit cards are both issued by Visa, so you’re protected from unauthorized use if your card is lost or stolen. Go2Bank notifies you via text message in case of suspicious activity on your account, and you can lock or unlock your Go2Bank cards instantly, with just a few taps in the app.

(The GoBank app closed all of its accounts in October 2021. Go2Bank is the replacement product offered by Green Dot and sometimes operates under the names Green Dot Bank, GoBank and Bonneville Bank.)

Does Go2Bank use Chexsystems or perform a credit check?

If you’ve had challenges with your credit score or have had a bank account involuntarily closed, Go2Bank may be a good option to access a full-featured bank account. Go2Bank does not use Chexsystems and will not check your credit, so Go2Bank may be a good ‘second chance’ bank if you have been turned away by other financial institutions.

Go2Bank can also help you to build or rebuild your credit through its secured Visa credit card, which you can also qualify for with no credit check. It gives customers the ability to build credit regardless of your credit history or income, and has no annual fee.

Simply set up direct deposit on your Go2bank account, receive direct deposits totaling at least $100 in the past 30 days and then easily apply for a Go2bank Secured Visa Credit Card within the app or online. Once you activate your card, just transfer at least $100 from your Go2bank account to make your security deposit and set your credit limit and it’s ready for use.

Go2Bank reports your on-time payments to the three major credit bureaus (Equifax, Experian and Transunion), which may help boost your score over time. You can track your progress with a free monthly credit score powered by Equifax®, too!

Does Go2Bank work with Cash App, Venmo or Zelle?

You can use your Cash App or Venmo account to transfer money from your linked Go2bank account. Go2Bank does not work with Zelle.

External transfers are limited to a total of $1,500 per month. This includes loading of a prepaid card account, moving funds into another financial account, external P2P transactions, or adding value to a digital wallet

Does Go2Bank require direct deposit?

You can use Go2Bank without setting up direct deposit, but you won’t have access to the full set of account features and you may be subject to higher fees.

You’ll need to set up direct deposit with Go2Bank to be eligible for overdraft protection and to participate in ASAP Direct Deposit, which can give you access to your paycheck two days early (and access to government benefit payments four days early). Go2Bank also waives its $5 monthly fee when you receive direct deposits in your account.

Does Go2Bank offer cash advances?

No, you cannot get a cash advance from Go2Bank. Check out these apps like Go2Bank for alternatives that do offer cash advances.

Up to $200 in overdrafts, up to 7% cash back offers and you can get paid two days early >>> Check out Go2Bank now!

Want to see more? Watch the top features of Go2Bank reviewed here:

Go2Bank Review – The Fine Print:

1 Monthly fee waived whenever you receive a payroll or government benefits direct deposit in the previous monthly statement period. Otherwise,$5 per month.

2 See app for free ATM locations. $3 for out-of-network withdrawals. ATM owner may also charge a fee. Limits apply

3 Ingo Money is a service provided byFirst Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Fees may apply. All checks subject to review for approval. Click here for more details.

4 The $5 promo code offer is valid only for users who successfully use the $5 promo code in the GO2bank mobile app before the promo code expires on 12/31/22. The $5 promotional incentive will be added to your approved check amount and transaction detail will be maintained in your GO2bank transaction history. All checks subject to review for approval. Fees may apply. Visit https://www.ingomoney.com/partners/greendot-terms-conditions/ for complete details. Not valid with any other offer. Limit one promotional incentive per GO2bank user and one redemption per registered account. Offer value of $5.00 may only be added to your registered account and may not be redeemed for cash. Offer sponsored by Ingo Money. GO2bank does not endorse or sponsor this offer.

5 Activated, chip-enabled debit card and opt-in required. $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. Go2Bank requires immediate payment of each overdraft and overdraft fee. Overdrafts paid at Go2Bank’s discretion, and Go2Bank does not guarantee that it will authorize and pay any transaction. Learn more about Overdraft Protection (PDF).

6 Direct deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

7 Activated chip-enabled GO2bank card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.