Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

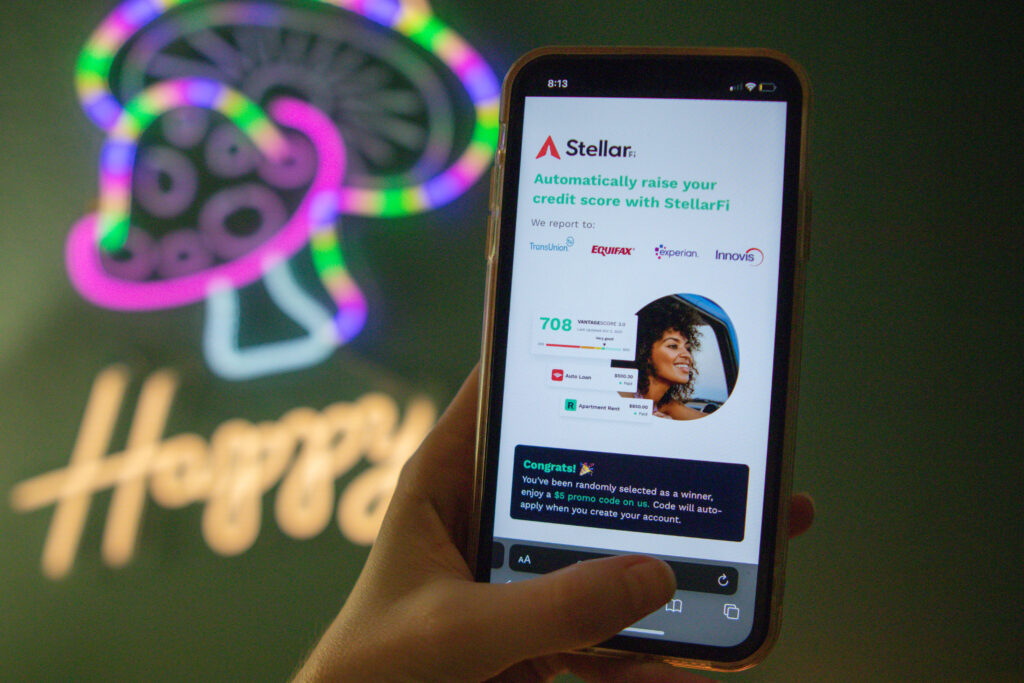

If you have a poor credit score, you know how challenging and expensive it can be to achieve your financial goals. From obtaining a credit card or car loan to simply renting an apartment, a low credit score can limit your options and cost you more money in interest and fees. StellarFi is a new credit building app that claims it can raise your credit score with locking you into a long-term loan or locking up your savings. How does it work and is it worth it? Read on for our StellarFi review.

Credit builder loans have become a popular solution for those looking to improve their credit. These loans are designed to help you build a positive payment history and improve your credit score while also helping you build up some savings, but they also come with some drawbacks. For example, fees can add up over time, and with loans like Credit Strong it can take a whopping years to get access to all of your savings!

StellarFi offers an innovative solution for those looking to improve their credit, with plans as low as $4.99 per month. Our StellarFi review details you can build credit without the costly fees and long payback period of credit builder loans.

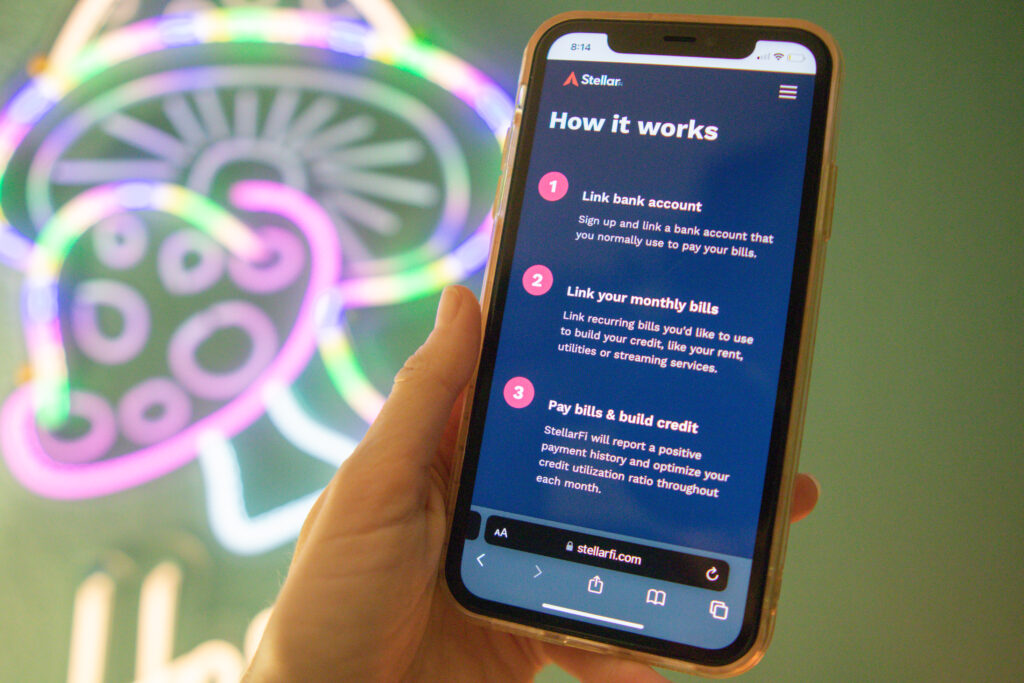

How does StellarFi work?

StellarFi is a subscription-based service that helps you build your credit score by reporting your on-time payment history to the credit bureaus. This is the largest component of your credit score, and just a few months of consistent payment history can have a meaningful impact.

StellarFi makes it easy to build credit by paying your bills on time. Here’s how it works:

- Signup for StellarFi, and get started for as little as $4.99 per month. There’s no credit check, no deposit, and no interest. No commitment, either – you can cancel anytime you want.

- Connect your virtual StellarFi Bill Pay Card as the main payment option for your recurring monthly bills, like Netflix, phone bills, and car insurance.

- StellarFi will automatically pay your bills on their due date (as long as you have enough money in your linked bank account) and transfer the amount of the bill from your linked bank account.

- When you pay your bills on time, StellarFi reports these positive payments to four credit bureaus, Experian®, TransUnion®, Equifax®, and Innovis.2

- The more bills you pay, the more payments get reported!

StellarFi offers two subscription options for users looking to improve their credit: the Lite and Prime plans.

The Lite Plan is just $4.99 per month and offers a variety of features to help users monitor and improve their credit score, including credit monitoring, personalized tips and alerts, and access to educational resources. You can have StellarFi make up to $500 per month in bill payments, and report those payments to credit bureaus. (This is reported as a line of credit to the credit bureaus, which may also have a positive impact on your credit score.)

Choose the Prime Plan for just $5 more ($9.99 per month) and you’ll increase your bill payment limit to up to $25,000, which may have an even bigger impact on your credit.

You’ll also get two big benefits that you won’t find with most other credit builder products. You can connect with a real live accredited credit coach from the National Federation of Credit Counseling, who can answer questions about building credit and help you create a personalized credit plan. And, you can get cash rewards from successful payments and put those dollars toward your next payments.

Try out the Prime Plan with a 30-day free trial! >>> Check out StellarFi

How much can StellarFi help your credit score?

StellarFi can improve your credit score by 50 pts in 30 days!3 StellarFi’s members enjoy an average of a 32-point increase in their credit scores during the first month.

Joining StellarFi and making regular on-time payments that are reported to credit bureaus can deliver a meaningful impact to your credit score. Through StellarFi, you can improve the two most critical credit-building factors: payment history and credit utilization. (Credit utilization is the portion of your credit lines that you are currently borrowing against. A high number is viewed unfavorably, so StellarFi helps bring this number down by reporting your bill payment limit as a line of credit.)

Adding a StellarFi membership may also cause your credit score jump, since when the StellarFi account is added to your credit report, your credit mix improves.

A higher credit score can have a significant impact on your finances, making it easier and less expensive to obtain loans, credit cards, and even rent an apartment. A higher credit score often leads to lower interest rates on loans, which can result in significant savings over time.

Ready to start building credit? >>> Check out StellarFi

StellarFi vs. Credit Builder Loans

StellarFi is a more affordable and flexible way to build your credit than a credit builder loan.

StellarFi won’t put added stress on your budget. The Lite Plan is just $4.99 per month and you cancel at any time. Compare this to the entry-level plan for credit builder loans like Self, which requires 24 monthly payments of $25 until you can access your savings.

StellarFi helps people build credit by tapping into their daily household bill payments. And, as a public benefit corporation, having a positive impact on society is a part of the company’s mission.

It’s also a great alternative to secured credit cards, which can tie your finances up in knots. For example, the popular Chime Credit Builder Card requires you to have a Chime checking account, set up at least $200 in monthly direct deposits, and move money into a secured account in order to use the card.

Is StellarFi legit?

StellarFi is a financial technology startup founded with the mission of making it easier for people to access credit and achieve their financial goals. The company is dedicated to helping people who have poor credit scores or limited access to credit to build a better financial future. StellarFi has established key strategic partnerships with credit bureaus Experian, Equifax, Transunion, and Innovis; along with a partnership with the National Foundation for Credit Counseling.

The fast-growing company was founded by a group of financial experts who recognized the challenges faced by people with poor credit scores. The company is a public benefit corporation, which means that its goals extend beyond simply making a profit. StellarFi is dedicated to making a positive impact on society and is committed to using its resources and expertise to help people achieve financial wellness.

Austin-based StellarFi has raised over $7 million in capital from several top venture capital firms. This funding has allowed the company to continue to grow and expand its offerings, helping more and more people access credit and build a better financial future.

StellarFi is a great solution for those looking to improve their credit. With its affordable cost, comprehensive credit monitoring and education tools, and access to live 1:1 credit counseling, it’s no wonder that more and more people are choosing StellarFi to help them achieve their financial goals.

If you’re ready to take control of your credit, sign up for StellarFi today!

Watch: Build credit with easy approval and no credit check with StellarFi

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- Cleo App Review – $250 Cash Advances and Wiseass AI Money Management - April 24, 2024

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- On-time payment history can have a positive impact on your credit score. Nonpayment may negatively impact your credit score. StellarFinance, Inc. will report your on-time payments to Experian®, TransUnion®, and Equifax®. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

- Credit score increase based on StellarFi member data. Credit score increase not guaranteed. On-time payment history can have a positive impact on your credit score. Nonpayment may negatively impact your credit score.