Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

Update: GoBank Closed All Accounts

GoBank, which is operated by GreenDot, ceased operations on October 31, 2021 and GoBank close all accounts. GreenDot simultaneously announced the launch of a new, similar banking product named Go2Bank. (Here’s our Go2Bank review.) However, accounts were not automatically migrated from GoBank to Go2Bank, resulting in many GoBank customers to complain that they were frozen out of their accounts.

Here’s the email that GoBank provided to its customers (via Doctor of Credit) announcing the brand’s closure:

As a valued customer, we’d like to inform you that your current GoBank® account program is ending October 31, 2021. To help you through this transition and enjoy even more banking features, we are making it easy to upgrade your account to GO2bank™, the ultimate mobile bank account.

Details about your account closing will be sent to the mailing address we have on file. Included will be an upgrade offer with more details on GO2bank, how to seamlessly transfer your account over to GO2bank by activating your new debit card, and how to continue direct deposits to your GO2bank account.

Please keep an eye out for this important mail arriving in a GoBank envelope.

We look forward to continuing to serve your banking needs.

GoBank Customer Service

GoBank is no longer offering customer service via its website, but does still operate two customer service phone numbers. GoBank MasterCard debit card holders can call (888) 288-1843 and GoBank Visa debit card holders can use (888) 280-8260.

Was your GoBank account closed? >>> Set up your Go2Bank account here

What is Go2Bank?

Go2Bank is a mobile bank account that provides a variety of features, including overdraft protection for up to $200 and the ability to access your paycheck two days early. With Go2Bank, you can get up to 7% cash back instantly on purchases from popular national retailers and restaurant chains.

Although there are no Go2Bank branches, you can use the Go2Bank debit card linked to your account to make purchases at any merchant that accepts Visa or withdraw cash from thousands of ATMs in the Go2Bank network across the US without any fees.2

Access up to $200 in overdraft protection >>> Get started with Go2Bank

Overdraft up to $200 with Go2Bank

Go2Bank provides a host of features that make it a convenient banking option. For example, you can deposit cash at almost 100,000 retail locations, including Walmart stores, Walgreens, and CVS. Additionally, Ingo Money3, which is built right into the app, allows you to cash a check within minutes by simply taking a photo of it on your phone. If you cash your first check using this feature, you will receive a $5 credit to your Go2Bank account (with the promo code GO2get5.4

Go2Bank also offers up to $200 in overdraft protection for debit card purchases.5 Though there is a $15 overdraft fee on overdrafts above $5, Go2Bank will waive the fees if you bring your account back to a positive balance within 24 hours of your first overdraft transaction. Furthermore, your Go2Bank overdraft coverage is linked to your direct deposit history, and your overdraft limits increase with your direct deposits.

Early access to paychecks with Go2Bank

Setting up direct deposit with Go2Bank provides you with early access to your paycheck.6 You can access your paycheck two days before payday, and if you receive government benefits, you can access them four days before they are due. Unlike other similar apps, such as Dave, Earnin, and Brigit, there is no fee for this service, nor will you be asked to leave a “tip.” Additionally, make qualifying direct deposits and Go2Bank waives the $5 monthly fee.7

Get your paycheck two days early >>> Get started with Go2Bank

Instant cashback with Go2Bank

With the Go2Bank app, you can buy eGift Cards from dozens of popular stores, restaurants, and online brands and get up to 7% cash back instantly.8 For example, when you dine out at a popular restaurant chain like Outback or Applebee’s, you can buy a $100 eGift Card through the app with just a few clicks and use it right away to pay the check. Plus, you’ll have $7 cash back instantly posted to your account.

While the brands participating in these offers may change over time, the current list of participating merchants offering 7% instant cashback includes popular stores and restaurant chains. The savings can add up quickly and can be substantial, making this a great feature for anyone looking to save money.

Up to $200 in overdrafts, cash back offers and get paid two days early >>> Check out Go2Bank now!

Though GoBank closed all accounts and is no longer operating, our previous review is below.

GoBank App Review

GoBank is a checking account that is accessible via your smartphone. There are no physical branches, but you can do more or less everything with GoBank that you would expect from a traditional bank.

GoBank offers a massive network of more than 42,000 ATMs where you can use your debit card to withdraw cash for free. Payroll and government direct deposits are free, and you can also deposit money into your account at any neighborhood Walmart, although a fee of $4.95 will apply. If you use an ATM outside of GoBank’s ATM network, a $2.50 fee also applies.

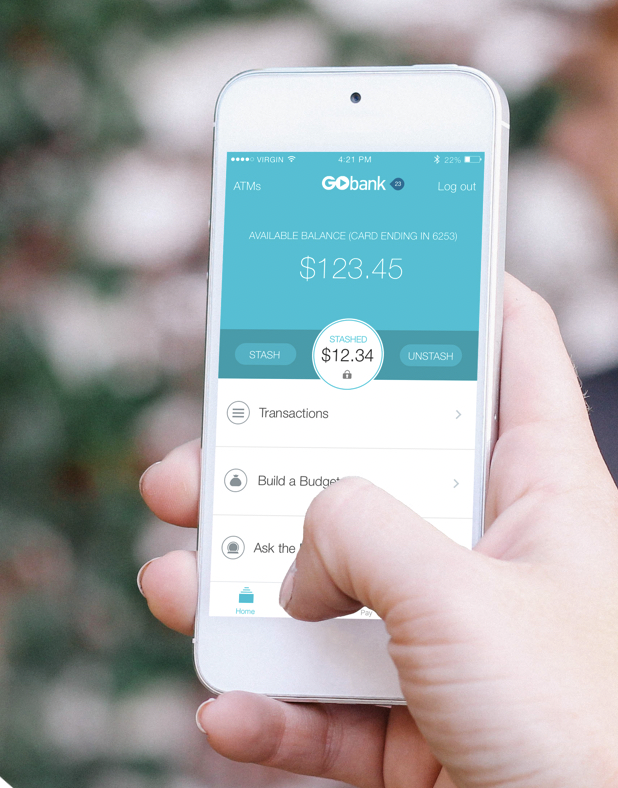

Using the smartphone app, you can check your balance quickly, see your transaction history, find nearby free ATMs, deposit checks and transfer money to another GoBank card.

One of the banking features that GoBank offers is a Money Vault where you can set aside some of your money for savings – although you won’t receive any interest for doing so.

Other GoBank fees

There’s no cost to sign up for a GoBank account online or via the app. However, if you purchase a starter kit from one of GoBank’s participating retailers, you’ll need to pay around $2.95, plus a deposit of $20-$500 to open the account.

There is a monthly maintenance fee of $8.95 to use GoBank, however providing you deposit $500 into your account each month via payroll or government direct deposit, this fee is waived.

GoBank doesn’t charge overdraft fees since it doesn’t offer an overdraft at all. (Here are banks that let your overdraft.). There are no other penalty fees to worry about, but if you want to order paper checks, it’ll set you back $5.95 for a pack of 12.

GoBank reviews

The GoBank app scores 4.4 / 5 on both Google Play and the App Store. The app has received many positive reviews so far with one recent App Store reviewer claiming that GoBank is the best prepaid and mobile bank available.

Over on Google Play, another happy user said that GoBank is probably the best checking account she’d ever had, stating that she gets her paycheck one day before most employees at her company and that she appreciated the daily balance alerts and ability to “stash” cash.

One of the latest reviews reflects on how the GoBank card works just like a regular bank debit card – this reviewer was very impressed with the statements, budget builder, paper checks and alerts to notify her of upcoming expenses.

Some of the more critical reviews refer to technical glitches and issues getting problems resolved with customer service. With that said, Green Dot Corporation, the company that owns GoBank, is quick to respond to both negative and positive reviews in the various app stores. There are a few ways to contact support; via phone, the website and through the app itself. The phone number to call appears on the back of the debit card.

GoBank document upload

When you open a GoBank account, you’ll be asked for identification details such as your name, date of birth and address, along with your social security number. You may also be asked to upload other identification documents to GoBank such as your driver’s license or another form of ID.

GoBank explains on its website why this information is needed – all financial institutions are expected to collect, verify and record customer information as set out by federal law to help prevent money laundering.

GoBank Uber

Uber has recently launched the Uber Visa Debit Card and checking account, which is powered by GoBank. As of April 24, 2018, this card replaced Uber’s Fuel Card.

The GoBank Uber Visa Debit Card allows Uber drivers to earn 3% cash back on gas at Exxon and Mobil stations when you use your pin at the pump. 1.5% cash back is available when using the card at all other gas stations.

Uber drivers can also opt-in to earn 2% cash back at Walmart and 10% cash back on auto part purchases at Advance Auto Parts. These are just a couple of the rewards on offer – there are more!

Is GoBank right for you?

GoBank more or less delivers on fee-free checking, as long as you sign up online, can deposit at least $500 each month and think you’ll make use of its free ATM network. The GoBank app itself is award-winning according to the GoBank website (although it’s not clear which awards the app has won). However, the majority of the reviews in the app stores are positive, which is a good sign.

Customer service is an important consideration when it comes to banking, so weigh up whether or not you’d be happy seeking phone or online support as opposed to visiting a physical branch and talking to a representative face to face.

Up to $200 in overdrafts, cash back offers and get paid two days early >>> Check out Go2Bank now!

Looking for other options? Check out these banks like Go2Bank

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- Cleo App Review – $250 Cash Advances and Wiseass AI Money Management - April 24, 2024

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- See app for free ATM locations. $3 for out-of-network withdrawals. ATM owner may also charge a fee. Limits apply

- Ingo Money is a service provided byFirst Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Fees may apply. All checks subject to review for approval. Click here for more details.

- The $5 promo code offer is valid only for users who successfully use the $5 promo code in the GO2bank mobile app before the promo code expires on 12/31/22. The $5 promotional incentive will be added to your approved check amount and transaction detail will be maintained in your GO2bank transaction history. All checks subject to review for approval. Fees may apply. Visit https://www.ingomoney.com/partners/greendot-terms-conditions/ for complete details. Not valid with any other offer. Limit one promotional incentive per GO2bank user and one redemption per registered account. Offer value of $5.00 may only be added to your registered account and may not be redeemed for cash. Offer sponsored by Ingo Money. GO2bank does not endorse or sponsor this offer.

- Activated, chip-enabled debit card and opt-in required. $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. Go2Bank requires immediate payment of each overdraft and overdraft fee. Overdrafts paid at Go2Bank’s discretion, and Go2Bank does not guarantee that it will authorize and pay any transaction. Learn more about Overdraft Protection (PDF).

- Direct deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

- Monthly fee waived whenever you receive a payroll or government benefits direct deposit in the previous monthly statement period. Otherwise,$5 per month.

- Activated chip-enabled GO2bank card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.