Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

We’ve broken down the overdraft policies for dozens of banks on this website, and none are as simple as Varo Bank. Varo has completely eliminated overdrafts and replaced them with an innovative product, Varo Advances, that it hopes will be friendlier on your finances.

Varo Bank overdraft limits, fees and protection

Unlike many financial financial apps that offer banking services through a partner bank, Varo is a FDIC-insured bank. It was the first digital-only bank in America to receive a bank charter and has grown rapidly by offering innovative products with low or no fees. (Other digital banking apps, such as Oxygen and Chime, offer services via a partner pank.)

You cannot overdraft your Varo Bank account (except for a few uncommon situations where it’s required by law.)

That means that if you don’t have enough money in your checking account to cover a debit card purchase, ATM withdraw, bill payment, or check, the transaction will not go through. Your Varo Bank debit card won’t work if you try to use it for a transaction that will push your balance below zero. (Varo offered no-fee overdrafts for up to $50 until it eliminated overdrafts in 2020.)

Varo also eliminated its overdraft protection program, so there’s no ability to link a savings account or credit card to your checking account and trigger automatic transfers when your account balance is about to turn negative. You can still make manual transfers between accounts, but you’ll need do this before making a debit card purchase, ATM withdraw or prior to a payment being processed for the transaction to be approved.

The good news is that you won’t incur any overdraft fees, and Varo Bank does not charge insufficient funds fees. You may face returned item fees and interest from the intended payee, though. And, no ability to overdraft means that you’ll avoid getting caught in the negative balance trap, which can be a tough and costly cycle to break.

Varo also offers the ability to access your paycheck two days early if you receive it via a qualifying direct deposit in your Varo account.

Why have 14 million people ditched their high-fee bank for Chime?

Get up to $100 with a Varo Advance

Not being able to use your debit card when you need it is inconvenient, and can sometimes leave you in a real lurch, especially if you need to pay for gas, groceries, or other necessities.

While you can’t overdraft your Varo debit card anymore, you may still be able to access the cash you need through a Varo Advance. Using the Varo app, you may qualify to receive an instant cash advance for up to $250 in your account, which you can use for purchases, withdraws, transfers via Venmo or Cash App, or any way you like.

You’ll have up to 30 days to repay your Varo Advance (and any advance fees). You can pick your repayment date when you request the advance, and if you need a bit more time there are no late fees.

How much can your borrow with a Varo Advance?

You can borrow up to $250 with a Varo Advance. You don’t need to apply and there is no credit check, however there are several criteria to qualify for an advance:

- Your Varo Bank Account must be at least 30 days old and active, so if you’re a new customer you can’t get an advance right away.

- You’ll need to have at least $1,000 in Qualifying Direct Deposits to either your checking or savings account (or both combined) within the last 31 days.

- You must have activated a Varo Bank Debit Card.

- Some additional account criteria apply.

Your first advance will be limited to just $20 and it’s free – Varo charges no fees on cash advances for less than $50. As you build up a track record of repaying advances on time and a longer account history, your cash advance limit can increase to up to $250. You can see how much you’re eligible for at any time in the Varo app.

In our survey of the 15 most popular cash advance apps, Varo came out on top as the lowest cost way to borrow $100. So while there are some hoops to jump through to qualify, it can be worthwhile to have a cheap way to instantly access extra cash when you need it.

What are cash advance apps that work with Varo?

While Varo is a national bank, it’s not compatible with many of the top cash advance apps, including Brigit, Earnin, and Grid Money.

However, when your account balance is getting low, Varo doesn’t provide many options to access extra cash. With no overdrafts, a long list of criteria to qualify for advances and an initial limit of just $20, you may want some extra options quick cash options on your phone that work with Varo so you can find additional funds when you need them.

Here are some leading cash advance apps like Varo that can give your account some extra spending power:

Albert offers cash advances for up to $250, with no interest or subscription required.3 You can request money with just a few taps in the app, and have it sent you your Varo debit card within minutes for a $6.99 express fee. Plan in advance, and you can have the funds sent to your Varo account in three business day with no fees.

There is no credit check and Albert doesn’t require you to move your direct deposit. You can qualify for up to three cash advances per pay period. Albert schedules your automatic repayment on the date of your next paycheck, but you can easily move it with no late fees.

The Albert app is free to download and also gives you a great set of tools to help you manage your money, better understand your spending, and achieve your savings goals.

No interest cash advances for up to $250 >>> Get the Albert app

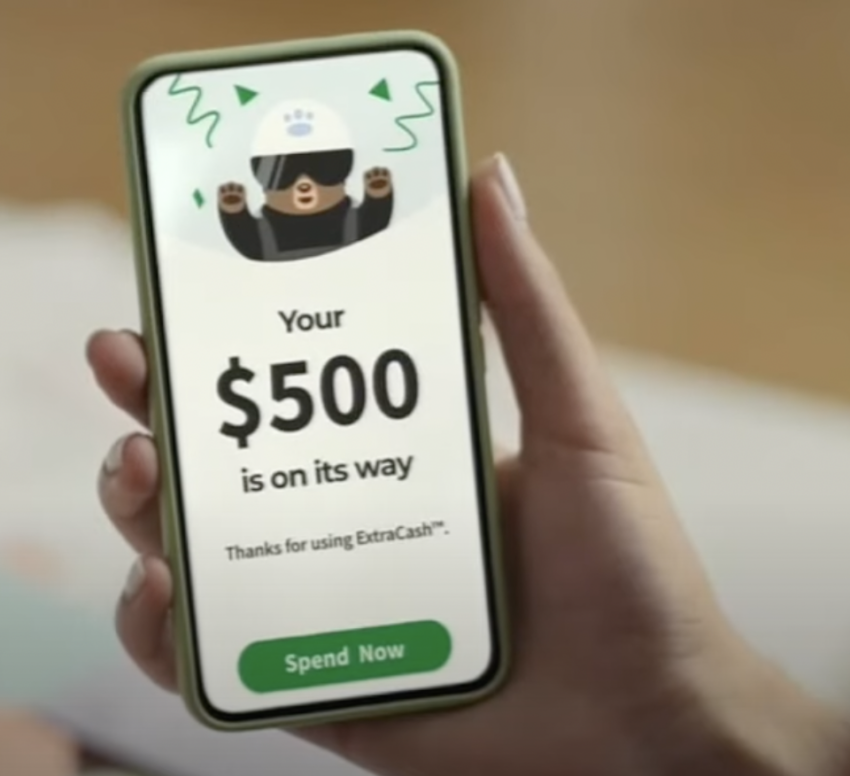

Dave is the original low-fee cash advance app, and you can qualify for a Dave cash advance for up to $5004. You can request a Dave cash advance as soon as you sign up. Dave has no separate limit for first-time advances, you may qualify for a larger cash advance on your initial request with Dave than you would with Varo or other apps. There is no credit check.

Dave will send your cash to your Varo account in minutes for an express fee of $2.99 – $13.99, depending on the size of the advance. Accessing your cash via a Dave debit card carries slightly lower fees, or you can have it moved to your Varo account in three banking days with no express fee.

Your Dave advance will be automatically repaid when you receive your next paycheck, but if you happen to need some extra time, Dave charges no late fees. You can borrow again once your advance has been repaid.

Get a cash advance for up to $500 instantly >>> Check out Dave

With MoneyLion Instacash, you can quickly borrow up to $250. There is no credit check, no interest, and no monthly fee.

Download and quickly setup the MoneyLion app and you’ll be instantly eligible for a $25 cash advance. Link MoneyLion to your Varo account, and your direct deposit history could quickly qualify you for a limit as high as $250. You can get as many MoneyLion cash advances as you like, up to your eligible amount.

MoneyLion will send your your cash to your Varo account in 48 hours for free. If you need it faster, you have it almost instantly with a $4.99 fee to have it sent to your Varo account or a $3.99 fee to have it deposited into your MoneyLion RoarMoney account, which you can access via a MoneyLion debit card.

Cash advances are just one part of the full-featured MoneyLion app, which also includes convenient tools for digital banking, credit building loans, budgeting and financial tracking, and rewards.

Get cash advances up to $250 with no interest >>> Check out MoneyLion

- Cleo App Review – $250 Cash Advances and Wiseass AI Money Management - April 24, 2024

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month and Visa debit card activation. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See terms and conditions.

- Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

- Download the Albert app to see if you qualify. Repay the advance with your next paycheck. Fees may apply. Advance amounts based on qualification and may vary. Albert is not a bank. Banking services provided by Sutton Bank, Member FDIC.

- ExtraCash™ is a DDA account with overdraft utility that is subject to eligibility requirements. Taking an ExtraCash™ advance will make your account balance negative. Express delivery fees apply to instant transfers. See the Extra Cash Account Agreement for more details.