Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

As an Uber driver, it’s not always easy to make ends meet.

Whether it’s been a slow week and you need to cover unexpected expenses or you’d just like some extra cash to tide you over until your next weekly direct deposit, you’re not the only one feeling frustrated at Uber’s payment limitations.

The problem is, cashing out your Uber earnings isn’t always fast or easy.

- You can get paid via a weekly bank transfer which costs nothing… but this can leave you short of cash.

- You can transfer your money to an Uber Pro Card which is available immediately… but your cash is tied to your card.

- You can cash out up to 5 times a day using Instant Pay… but you’ll be charged $0.85 every time you want to access your money.

If you’re looking to get paid without having to jump through Uber’s hoops, we don’t blame you. That’s where cash advance apps can be a lifesaver.

In this article, we’ll review some of the best cash advance apps for Uber drivers, so you can get access to the funds you need when you need them.

Why is Cleo one of our favorite cash advance apps?

- Super speed - Get up to $250 in your bank account today!2

- No, No, No! - No credit check, no interest, no tips, no late fees

- 😂 😂 🤣 - Hilarious, smart money advice you might finally listen to

What are cash advance apps and how do they work?

Cash advance apps allow you to borrow money quickly and easily using your smartphone.

These apps are designed to help you bridge the gap between paychecks or unexpected expenses by providing access to small amounts of cash – often without punishing you for being a gig worker or having a poor credit score!

| OVERDRAFT TIPS: Got a need for speed? If approved, cash advance funds are deposited directly into your bank account, often within hours or even minutes. And unlike traditional loans, which can take days or even weeks to process, cash advance apps offer near-instant access to your money. |

Since repayment terms and fees vary depending on the specific app (more on those below), you can shop around and find a deal that works for you.

Why cash advance apps are perfect for Uber drivers

Cash advance apps can be particularly useful for Uber drivers because they provide access to quick cash that can be used to cover unexpected expenses, such as car repairs.

As an Uber driver, you’re considered an independent contractor and are responsible for maintaining your own vehicle, which can be a costly and time-consuming process.

Cash advance apps offer a convenient solution for drivers who may not have the funds to cover these expenses out of pocket. You can get back on the road and earn money quickly, without having to wait for traditional loans or other forms of financing.

In addition, cash advance apps may be more accessible to Uber drivers with poor credit or no credit history. Traditional lenders may be hesitant to provide loans if you’ve got less-than-perfect credit, but cash advance apps often have more lenient credit requirements.

| Overdraft Apps Tip: Since Uber drivers are paid on a weekly basis, it’s easy to run into cash flow problems from week to week. Cash advance apps like Dave and Cleo can provide a source of predictable, short-term financing that can be used to cover expenses as they arise, without disrupting the driver’s overall cash flow. |

5 best cash advance apps for Uber drivers

As an Uber driver, unexpected expenses like car repairs or medical bills can take a toll on your finances and leave you wondering where to get cash if your account is overdrawn.

While there are traditional loan options available, they may not be the most convenient or accessible for everyone and some cash advance apps, such as FloatMe, aren’t compatible with Uber. To help you find the best cash advance app for your needs, we’ve put together a list of some of the top cash advance apps for gig workers:

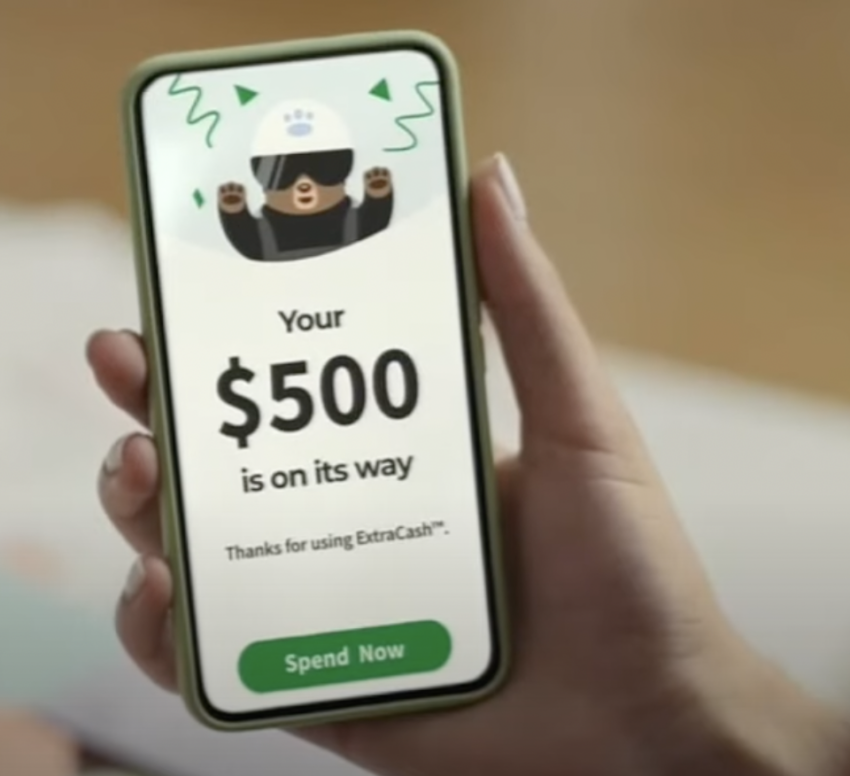

#1 – Dave: Drive away with up to $500 from the OG cash advance app

Dave is the original apps catering to Uber drivers – and with a $500 ExtraCash advance available in seconds, it’s one of the best.

Like others on this list, Dave works by letting rideshare drivers borrow small amounts of money. Whether you’re borrowing as little as $25 or borrowing $200, immediate access to cash can help you skip the headaches (and high fees) that come from overdrafting.

Dave is free to download and easy to use. Best of all, new users can receive a cash advance of up to $500 immediately. With the Dave Debit Mastercard, you can have your money in literally minutes!

You will need to be a paying member to be eligible for advances. However, this will only set you back *drumroll* $1 per month.

With no interest or credit checks, Dave is an affordable option for Uber gig workers.

Get a cash advance for up to $500 instantly >>> Check out Dave

| Pros | Cons |

|---|---|

| ✔ Cash advances up to $500 | ✘ 1-3 business days to external checking account |

| ✔ No interest or fees | |

| ✔ No credit check |

#2 – Brigit: Uber drivers can borrow up to $250 in fee-free overdrafts

Brigit is one of the most popular cash advances for Uber drivers, giving you an easy way to withdraw between $50 and $250 per pay period with no interest.

Your borrowing limit is tailored to your needs and ability to repay, so you’re supported to borrow responsibly.

There is a $9.99 monthly fee for using Brigit’s cash advance feature BUT think of it this way – how many late fees, dishonor payments, or overdraft fees cost less than $9.99?

That’s why a monthly subscription can end up saving you money in the long run as an Uber driver. With the Brigit app on your phone, you don’t even need to worry about paperwork or admin. The app will analyze your account, let you know if you qualify for a cash advance, and tell you exactly how much.

Among the list of best cash advance apps for Uber drivers, Brigit’s borrowing limit of $250 is one of the highest.

Access up to $250 in fee-free overdrafts >>> Explore Brigit Now

| Pros | Cons |

|---|---|

| ✔ Cash advances up to $250 | ✘ $9.99 monthly fee |

| ✔ Zero interest | |

| ✔ High borrowing limit |

#3 – MoneyLion: Low-cost cash advances for rideshare drivers for up to $250

MoneyLion provides comprehensive mobile banking all available from your smartphone.

Among its top features for Uber drivers is Instacash. This feature allows you to receive cash advances of up to $250 with no interest or monthly charges.

To qualify, you must have a recurring direct deposit – but this doesn’t need to come from a direct employer. For gig workers or those with fluctuating incomes, this is a huge advantage.

Here’s what you’ll need as an Uber driver to qualify for MoneyLion Instacash:

- A verifiable checking account you own

- At least two months’ account history

- Recurring deposits (doesn’t need to be from a full-time employer)

- A consistently positive balance

- Enough activity to show both deposits and expenses

There’s no credit check to apply, and no compulsory fees aside from the optional tip (which works similarly to apps like Earnin and Dave). Your ability to utilize Instacash isn’t affected by whether you tip or not.

Get cash advances up to $250 with no interest >>> Check out MoneyLion

| Pros | Cons |

|---|---|

| ✔ Fee-free overdrafts up to $250 | ✘ 3-5 business days to external checking account |

| ✔ 0% APR cash advances | ✘ Requires bank account for access |

| ✔ No credit check |

#4 – Earnin: The free app offering up to $500 in no-fee cash advances

Earnin is a handy tool for gig workers who need access to their earned wages before their scheduled payday.

This is particularly beneficial for Uber drivers, whose basic payment model runs from Monday 4 am to Monday 3:59 am. Payments are transferred directly into your nominated bank account. But, according to Uber’s website, payments are usually reflected on Thursday evenings.

That’s a long time to navigate without the wages you’ve earned!!!

With Earnin, you can withdraw up to $100 per day and up to $500 per pay period, without incurring any interest or fees. The app is free to use, and while a tip is encouraged, there’s no obligation. When your next paycheck is received, Earnin automatically pays back the outstanding balance.

Simple!

While Earnin does work with Uber, drivers will need to manually input their time and hours, which can be frustrating, but it doesn’t stop you from using the app.

Borrow Up To $100 Right Now >>> Get started with Earnin here

| Pros | Cons |

|---|---|

| ✔ Access up to $100 per day | ✘ Requires regular pay schedule |

| ✔ Access up to $750 per pay period | ✘ Requires bank account for access |

| ✔ 0% interest |

#5 – Gerald: No credit check cash advances for up to $215

Gerald is quickly climbing the ranks of the most popular cash advance apps thanks to instant cash advances for up to $215 with no interest and no credit check. While Uber drivers can have trouble getting approved by most cash advance apps, Gerald puts out the welcome mat for them.

It’s certainly worth checking out if you’ve had trouble getting approved elsewhere, but the app can be a bit clunky and expensive as we detailed in our full Gerald app review. Fees can be as high as $29 on a cash advance if you follow Gerald’s encouragement to leave a 15% tip, making it one of the most expensive apps we’ve tested to borrow $100. There is a high volume of customer complaints about slow delivery times – sometimes exceeding one week – and the app can be quite clunky to use.

#6 – Moves Financial: $2,000 loans for Uber drivers, but unclear fees

Moves Financial is specifically tailored for gig workers, such as Uber drivers. You can borrow up to $2,000 without a credit check. However, while there is no interest and no late fees, the cost of borrowing isn’t disclosed as clearly as it is on other lending products and can be quite high.

To apply for a Moves Financial cash advance, you’ll need to download the app and link your Uber account to your Moves profile. Your cash advance limit is based on your Uber earnings, which will be directed in a spending account at Moves partner bank. The repayment of any borrowed amount is automated, with a percentage of the gig deposit being deducted to cover the advance. The exact percentage is user-selected, starting at 10%. Notably, while one might have a borrowing limit of up to $2,000, only one cash advance can be active at a time.

Moves cash advances are structured to be business loans, so rates and fees are not as clearly disclosed as they are on a typical consumer loan. Though Moves Financial does not charge interest on cash advances, a service fee is applied every time an advance is taken. An example provided indicates a $1,000 advance incurring a $150 service fee, totaling a repayment of $1,150. Additionally, transferring funds from the Moves Spending Account to another bank account comes with a 1.75% charge. As with any loan for Uber drivers, make sure you fully understand the cost of borrowing before you sign on the dotted line.

Check out our Moves Financial review.

Bonus App: Giggle Finance

Giggle Finance offers personal loans for Uber drivers whether you’re facing car repairs or personal expenses.

A funding platform created specifically for gig workers (it’s in the name!) you won’t be asked to prove your credit score, Instead, Giigle analyzes your bank statements to see how much you can afford – so you’re not stretching yourself too thin.

Once approved, you can borrow up to $5,000 with the money available in minutes.

Check out our Giggle Finance review

Watch: Best Cash Advance Apps for Gig Workers

As an Uber driver, having access to cash when you need it can be critical to your financial stability.

By using a cash advance app, you can get the funds you need quickly and easily.

Remember to consider the factors that matter to you (loan amount, repayment schedule, fees and charges), and you’re all set to choose the app that works best for your needs and budget.

BEFORE YOU GO…

Check out our most popular articles:

- Free Instant Cash Advance Apps (We Found The Best of The Best)

- Borrow up to $200, and win up to $100 a day with Klover

- How to Get $25 in A Couple of Clicks (Cash Through Your Smartphone)

- Start Building Your Credit For Just $5 Per Month (SERIOUSLY!!!)

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- Subject to eligibility. Amounts range from $20-$250, and $20-$100 for first time users. Amounts subject to change. Same day transfers subject to express fees.