Editor’s Note: Overdraft Apps provides detailed product reviews and recommendations based upon extensive research and our own hands-on testing. We may earn a referral fee when you sign up for or purchase products mentioned in this article.

Need a little extra cash to get you through until payday?

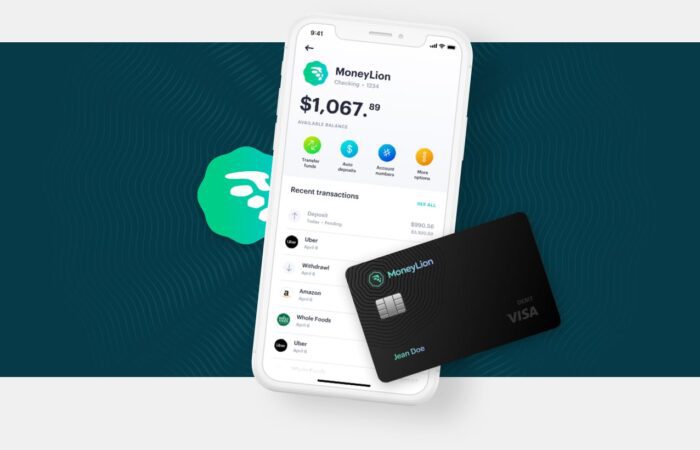

With 64% of Americans living paycheck to paycheck, apps like MoneyLion are growing in popularity by offering interest-free cash advances with a range of extra features including no overdrafts or hidden fees.

While MoneyLion breaks down traditional barriers to financial health and provides instant cash to hard-working Americans, it’s not the only cash advance app available to provide funds.

Why is MoneyLion one of our favorite cash advance apps?

- Super speed - You could have up to $500 in your bank account in under 10 minutes!

- No, No, No! - No credit check, no interest, no tips, no late fees

- 🏗️ 💳 💵 - Get the only credit builder loan that gives you up to $1,000 right away, with no hard credit check2

If you need cash to help you pay for food, bills, gas, or pay for emergency expenses, we’ve rounded up seven apps similar to MoneyLion Instacash3, plus pros and cons, and any costs to use.

What is MoneyLion Instacash (and how does it work?)

Founded in 2013, the MoneyLion app is a mobile banking platform offering interest-free cash advances to help customers make ends meet until payday or to cover unexpected bills. One of the most popular cash advance apps, MoneyLion Instacash provides a cash advance of up to $500 with no interest, no monthly fee, and no credit check.

To access funds, you’ll need to download the MoneyLion app then link your checking account before you qualify for cash advances. Using MoneyLion’s Instacash feature, you can request a cash advance to fill your tank, grab textbooks for school, or treat yourself to a night out.

Your recurring income or regular deposits raise the amount of cash you can access (from $50 to $500) and the amount you receive is automatically deducted from your account on a due date that’s determined by your pay cycle or recurring deposit cycle – all with zero interest.

Get cash advances up to $500 with no interest >>> Check out MoneyLion 👈

Seven apps like MoneyLion Instacash

As we detail in our MoneyLion Instacash review, there’s a lot to like about 0% APR cash advances that you can access with just a few clicks in the app. However, there are a few drawbacks to MoneyLion that may make some alternative apps a good addition to your financial toolkit:

- Lower cash advance limits. When you get started with MoneyLion, your Instacash limit will only let you borrow $25 (or borrow $50 with qualifying direct deposits set up). You’ll need regular direct deposits to a MoneyLion RoarMoney account to access the maximum $500 cash advance limit

- Only one cash advance per pay period. Other wage advance apps, like Earnin, allow you to access cash as often as daily, so you’re not waiting around for your next paycheck to arrive.

- You’ll pay a fee to get fast cash. While there is no fee to have your MoneyLion cash advance sent to your bank account, this option takes 3 – 5 business days. If you want the money sent to your bank account in minutes, you’ll need to pay MoneyLion’s Turbo delivery fee, which costs up to $8.99 for Instacash advances of $90 or more.

- If you’re looking to build your credit, MoneyLion’s Credit Builder Plus is the only credit builder loan that will give you up to $1,000 upfront! However, you’ll have to pay a $19.99 monthly fee in addition to your principal and interest payments on the loan.

Still want a $500 cash advance with no interest? >>> Check out MoneyLion 👈

If you’re looking for alternatives without these drawbacks, check out these other cash advance apps like MoneyLion.

#1 Albert App – Up to $250 in no-interest, no-fee cash advances

It’s no surprise that Albert is one of the most popular paycheck advance apps – you can get up to $250 in cash almost instantly without fees or interest!4

Getting started by downloading the Albert app, quickly connect it to your bank account OR keep your bank account separate. Albert cash advances are available whether you move your direct deposit or not – though setting up an Albert Cash account will give you access to near-instant cash advances and access to your paycheck up to two days early.

The advance is automatically repaid through your next paycheck, though you can change this date to be earlier or later.

| Pros | Cons |

| ✔ Borrow up to $250 | ✘ Customer service via email only |

| ✔ Range of FREE financial tools in-app | ✘ Must link bank account for instant cash advances |

| ✔ No interest on the amount borrowed |

Get up to $250 with no credit check >>> Check out Albert

#2 PockBox app – Comparison shop loan offers for up to $2,500

Pockbox is an online lender app that allows you to borrow a relatively high amount compared to MoneyLion but lower than a service like CashUSA.

With PockBox, you can get approved for amounts as low as $100 and up to a $2,500 loan in a few minutes. This app isn’t as integrated as other apps (such as MoneyLion), which requires you to connect your bank account. However, there are no monthly subscriptions to use Pockbox, just a loan, and its repayments.

While you can get approved quite fast, always read the APR and the terms.

Compare multiple loan offers in minutes with PockBox.

| Pros | Cons |

| ✔ Receive up to $2,500 | ✘ Must have regular income to qualify |

| ✔ No fees or charges | ✘ Funds take 1 business day |

| ✔ Get approved in minutes |

#3 – Dave App – Instant cash advances for up to $500 with no credit check

If you’re trying to find an app like MoneyLion, Dave deserves a good look. You can use Dave to borrow up to $500 nearly instantly with zero interest and no credit check.5

The app is free to download and fast and easy to set up, and you may be eligible for a Dave cash advance for as much as $500 as soon as you sign up! Dave looks at a number of factors, including how long until your next payday, your history and spending patterns, and how much is deposited into your bank account each month. There is no credit check, so don’t worry if your credit score isn’t where you want to be.

Once approved, Dave gets your funds to you nearly instantly (seriously, like in under a minute!) via the Dave Debit MasterCard; there is a $1.99 – $9.99 express fee depending upon the size of your advance. Use your Dave debit card to withdraw cash from an ATM or to pay for purchases wherever MasterCard is accepted (so basically everywhere nowadays). Your Dave debit card can help you access some impressive savings too, such as up to 10% cash-back at popular restaurants and retailers, and some limited special opportunities like 50% cash-back on your next order from Shake Shack!

If you’d rather have your cash advance sent to your existing debit card in minutes, that’s an option too, though fees do apply. You can even ditch the express fees by having Dave transfer your cash advance to your bank account, though it will take three banking days for your funds to arrive. (Regardless of the method you choose, you will need to subscribe to Dave for $1 per month to access cash advances plus some additional features. You can cancel at any time.)

Dave will schedule repayment of your advance for the date when you’ll receive your next paycheck, but if you happen to need some extra time, Dave doesn’t charge late fees. You can borrow again once your advance has been repaid.

Get a cash advance for up to $500 instantly >>> Check out Dave

| Pros | Cons |

| ✔ Low subscription fee ($1/month) | ✘ Express fees to get your money right away |

| ✔ Borrow up to $500 | ✘ Must provide linked bank account |

| ✔ No credit check or interest | ✘ Automatic withdrawals for repayments |

#4 – Go2Bank – Full powered banking from your phone

Go2Bank is a mobile bank account with an impressive set of tools to help you manage your money – including up to $200 in overdraft protection. Download the free Go2Bank app and you can open a bank account in minutes, with no credit check and no minimum balance requirement.

Set up a qualifying direct deposit with Go2Bank and you unlock some valuable benefits, including up to $200 in Go2Bank overdraft privileges.

The list of Go2Bank’s features goes on and on, including the ability to cash a check6 in minutes directly through the app and instant cash back offers7 of up to 7% on eGift Cards to tons of popular stores, restaurants and entertainment brands – you won’t find many of these deals anywhere else!

| Pros | Cons |

| ✔ Overdraft up to $200 | ✘ Direct deposits required |

| ✔ Access your paycheck two days early | ✘ $5 monthly fee without direct deposits |

| ✔ Get 7% instant cash back on eGift Cards |

Access up to $200 in overdraft privileges >>> Get started with Go2Bank

#5 – Chime SpotMe – up to $200 in fee-free overdrafts

Chime SpotMe® can provide you up to $200 in fee-free overdrafts.8

Like MoneyLion, Chime is an easy and convenient financial app that helps you manage and access your money. SpotMe lets you shop online via a debit card and you can even overdraft your account with no overdraft fees. Limits start at $20 and can be increased up to $200.

There is no cost to enroll in SpotMe. Once you set up your account to receive a qualifying direct deposit of $200 or more a month, Chime will cover up to $200 in overdrafts on your account – without charging you overdraft fees!

Here’s an example of how SpotMe can help you access the cash you need without incurring costly overdraft fees:

You want to pay for a $65 dinner (you deserve it), but you’ve only got $50 in your bank account. With most banks, a debit card transaction would incur a $35 overdraft fee, turning that well-deserved meal into a $100 expense! If you’ve set up SpotMe (and your paycheck is directly deposited into your account) you can use your Chime debit card to pay for that meal. The $15 overdraft will be covered with no fee to you and the next time you make a deposit to your Chime account, the $15 negative balance is paid off.

SpotMe doesn’t have high overdraft limits, but it will show you how much you can spend right in the app to help you avoid fees, as well as those embarrassing moments when your transactions are declined. There’s no loan application to fill out and you can instantly access $20 in overdrafts (which can help you avoid those frustrating fees banks charge you for being overdrawn by just a few dollars) and you can grow your limit over time.

The best part? The sign-up process is quick and easy (less than 2 minutes) >>> Get started with Chime

| Pros | Cons |

| ✔ Up to $200 a month in overdrafts | ✘ Only for debit card transactions |

| ✔ No overdraft fees | ✘ Requires Chime bank account |

| ✔ No account linking required |

#6 – HonestLoans app for fast cash

HonestLoans will get you money very quickly (with a 5-minute application process) as an aggregator connected to dozens of lenders. This app similar to MoneyLion will, according to your financial background and request, let you borrow money. You can ask for between $100 and $2,500. Unlike MoneyLion Plus, you don’t have to pay any monthly fees in order to get access to money.

However, the HonestLoans app is not a financial planner – just a cash advance app. That said, it is a great solution if you need cash quickly. But, as with any money borrowing app, be aware of the conditions before you accept a loan.

| Pros | Cons |

| ✔ Borrow $100 to $2,500 | ✘ Fees and interest depend on lender |

| ✔ Apply online in 5 minutes (no lines!) | ✘ Loans are not a long-term funding source |

| ✔ Flexible eligibility criteria | ✘ Generally high fees and interest rates |

Final thoughts and what to do next…

Choosing an app like MoneyLion means weighing up the pros and cons on offer. From fees to credit checks, loan amounts, and interest, each cash advance app offers different value.

If you have poor credit or no credit score, you may be better off checking out credit builder loans like Self Lender or SeedFi, too.

These apps allow you to quickly borrow the cash you need, whether as a loan or advance on your next paycheck, and with the seven options listed in this article you’ve got all the information you need to find the app, and service, that best suits your needs.

CHECK OUT OUR MOST POPULAR ARTICLES BEFORE YOU GO:

- How to Build Credit for Just $5 Per Month 🔥

- Easy Ways to Borrow $100 FAST 🔥

- Easy Way to Overdraft at an ATM (When You’re Low on Funds) 🔥

How we picked these apps like MoneyLion Instacash

To come up with this list of cash advance apps, we picked a handful of apps like MoneyLion Instacash, downloaded them onto our phones, and got to work testing them out. We considered features including fees (upfront or hidden), eligibility, borrowing limits, and interest rates. We also looked for additional features that might benefit Americans living paycheck to paycheck. These include credit checks, speed of accessing funds and overdraft support. We may receive a referral fee if you purchase or use some of the products described in this article.

WAIT! Why borrow quick cash when you can earn it?!

Cash advance apps can be a great tool for getting a little extra cash when you need it, but you’ll need to repay it – plus fees – wihtin a week or two. Did you know there’s an easy way to earn extra cash that’s yours to keep?

KashKick is a wildly popular service that lets you earn money for playing games, completing surveys, signing up for trial offers and more. (You’ll even earn cash for just completing your profile!) You can earn cash today and withdraw your earnings through PayPal once you’ve reached $10. You can earn over $100/month with KashKick – and you don’t need to spend a dime or take out your credit card to do it.

There are dozens of high-paying offers available on KashKick, and if you’re into playing new games on your phone, you can earn some serious cash for doing what you love. Though offers change regularly, there are currently1 more than three dozen offers available where you can earn cash – sometimes over $100 – just by downloading and playing popular games like Coin Master, Monoply Go, Bingo Blitz, and more. These games are all free to download, and no in-app purchases are required to earn with KashKick.

Get paid to play on your phone >>> Check out KashKick

- Cleo App Review – $250 Cash Advances and Wiseass AI Money Management - April 24, 2024

- FloatMe Review – Simple $50 Cash Advances with Low Fees - April 17, 2024

- MoneyLion App Review: Save, Invest & Borrow up to $1,000 in One Simple App - April 15, 2024

- As of February 13, 2024. Offers may change and may not be available to all users. Eligibity requirements apply. See KashKick's Terms of Service for full details.

- When you apply for CreditBuilder Plus, MoneyLion will perform a soft credit pull to review certain financial information. This soft inquiry has no impact to your credit score and may or may not be recorded in your credit reports depending on the bureau. This is unlike a hard credit pull which affects your credit score and can appear on your credit report for two (2) years. Credit score improvement is not guaranteed. A soft credit pull will be conducted that has no impact to your credit score.

- Instacash is an optional service offered by MoneyLion. Your available Instacash Advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. See Membership Agreement and help.moneylion.com for additional terms, conditions and eligibility requirements.

- Download the Albert app to see if you qualify. Repay the advance with your next paycheck. Fees may apply. Advance amounts based on qualification and may vary.

- ExtraCash™ is a DDA account with overdraft utility that is subject to eligibility requirements. Taking an ExtraCash™ advance will make your account balance negative. Express delivery fees apply to instant transfers. See the Extra Cash Account Agreement for more details.

- Ingo Money is a service provided byFirst Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Fees may apply. All checks subject to review for approval. Click here for more details.

- Activated chip-enabled GO2bank card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

-

Chime SpotMe eligibility requirements and overdraft limits: Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. See Terms and Conditions .

Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC.